Davis Commodities launches $30 million blockchain and bitcoin strategy

Carter Hoffman

Jun 24, 2025

Devanshee Dave

Jun 23, 2025

Devanshee Dave

Jun 23, 2025

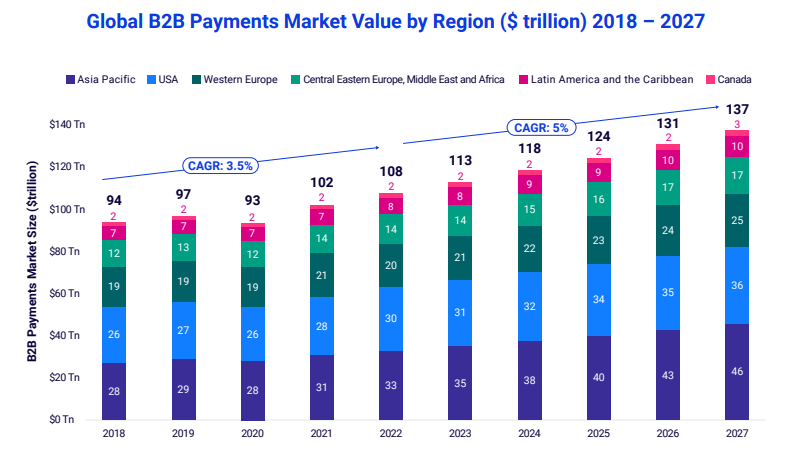

The global business-to-business (B2B) payments market is on track to grow from $113 trillion in 2023 to $137 trillion by 2027 at a CAGR of 5%, reveals a new study titled “7 best practices to capture opportunities in the fast-growing $137 trillion global B2B payments market,” by Edgar, Dunn & Company (EDC). This growth, despite recent economic challenges, highlights the critical importance of digital transformation in corporate payment processes.

While the pandemic accelerated the shift towards digitalisation, the current efficiency demands and technological advancements are the driving factors in the transition from paper-based to electronic payment methods. Asia Pacific currently dominates the global market with $35 trillion in annual B2B payment volume, followed by the United States at $31 trillion and Western Europe at $21 trillion.

Despite this, compared to Business-to-Consumer (B2C) payments, B2B payments have significantly lagged in the adoption of new technologies. Approximately one-third of total B2B global expenditure is processed electronically, compared to two-thirds of B2C global expenditure. To improve this situation, B2B payment providers need to understand challenges and implement new-age solutions, says the study.

The B2B payments value chain has transformed dramatically. Traditional bank-dominated services have given way to specialised digital ecosystems focused on efficiency and integration. For instance, paper-based processes that once required 10 days and cost $10.90 per invoice have been replaced by automated solutions completing the same work in 3.1 days at $2.60, an 81% cost reduction.

This shift occurred in three distinct phases. First, companies replaced manual workflows with digital automation. Next, optimisation engines emerged to maximise rebates and identify cost-effective payment methods. Finally, the roles within the value chain expanded beyond traditional boundaries.

The pandemic also had its share of continuation for B2B payments, as lockdowns and restrictions meant that SMEs and corporates were unable to process manual and paper-based activities, resulting in increased payment delays and disruption in the B2B value chain. This forced businesses to rapidly digitise operations, with a Mastercard survey revealing 82% of SMEs implemented payment system changes, 75% citing COVID-19 as the direct primary reason for the change

Over the years, many new Fintechs such as Adyen, Stripe, Bud, TrueLayer and WEX have entered the market, competing with traditional banking players, targeting specific use cases and profitability pockets. These new entrants have developed innovations like “card-to-account” solutions where buyers use corporate cards while suppliers receive ACH payments, creating seamless processing into existing systems.

The market has evolved from disconnected operations to integrated ecosystems where payments function as strategic tools rather than simple transactions. These systems now optimise cash flow, reduce the $3 billion annual fraud exposure, and create balanced value propositions between trading partners.

The global B2B payments landscape represents a massive economic ecosystem that continues to expand despite recent economic challenges. Prior to the pandemic, this market experienced steady growth, but COVID-19 temporarily reversed this trend, causing a 4% contraction between 2019 and 2020.

The subsequent recovery was further hampered by the conflict in Ukraine, which increased commodity and energy prices, spurred inflation, and eroded business confidence worldwide.

Despite these headwinds, the market has rebounded strongly. According to EDC’s analysis, the global B2B payments market reached $113 trillion in 2023 and is projected to grow at a compound annual growth rate of 5% to reach $137 trillion by 2027.

This growth is not evenly distributed across regions. Asia Pacific currently leads with the largest share at $35 trillion, reflecting the region’s expanding economies and increasing digital adoption.

The United States follows closely at $31 trillion, while Western Europe accounts for $21 trillion. The remaining market is divided among Central Eastern Europe, the Middle East and Africa (CEMEA) at $14 trillion, Latin America and the Caribbean at $8 trillion, and Canada at $2 trillion.

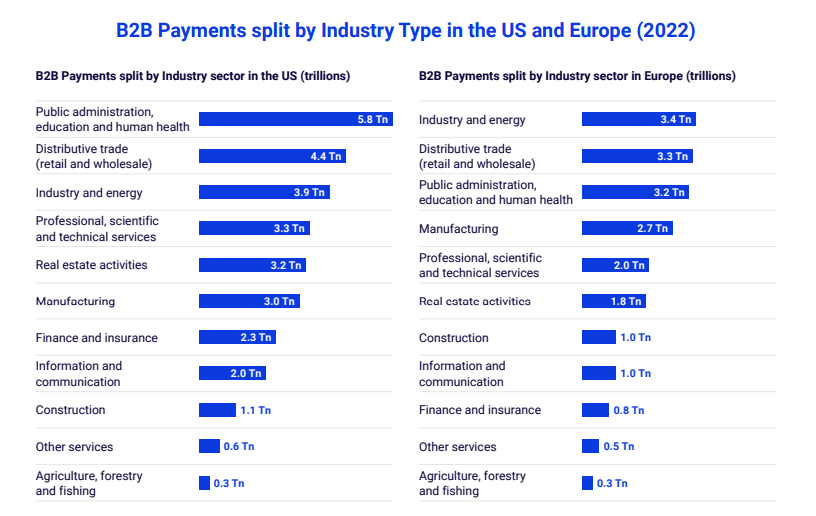

Within these regional markets, EDC’s research reveals important variations across industry sectors. In both the United States and Europe, three sectors dominate B2B payment volumes: public administration/education/health services, distributive trade (retail and wholesale), and industry/energy.

The U.S. market demonstrates the economic weight of the public sector, with public administration generating $5.8 trillion in B2B payments, followed by distributive trade at $4.4 trillion and industry/energy at $3.9 trillion. Europe shows a similar pattern, with public administration accounting for €3.4 trillion, distributive trade at €3.3 trillion, and industry/energy at €3.2 trillion.

Another critical dimension of market segmentation emerges when examining company size. In the United States, large corporations (those with annual revenue exceeding $500 million) account for 54% of all B2B payments, representing $16 trillion. Meanwhile, small and medium enterprises generate the remaining 46%, or $14 trillion.

This bifurcation of the market highlights two distinct strategic approaches required by payment providers. First, solutions targeting large corporations must seamlessly integrate with sophisticated existing infrastructure and address complex needs spanning multiple departments and geographies. These enterprises typically seek comprehensive solutions that can be deployed across their entire organisation while maintaining compatibility with established systems.

Second, the substantial SME segment requires fundamentally different approaches. These businesses typically lack the resources and technical infrastructure of their larger counterparts, necessitating solutions that are easy to implement, require minimal technical expertise, and deliver immediate efficiency gains without significant upfront investment.

For payment providers seeking to capture a share in this growing market, understanding these nuanced differences across regions, industries, and company sizes is essential for developing targeted solutions that address specific pain points within each segment.

EDC research reveals payment providers must master six critical pain points to succeed: manual processes, cashflow struggles, ecosystem complexity, poor integration, hidden costs, and change resistance. Those delivering solutions addressing these specific challenges capture market share rapidly.

To address these, the report also mentioned seven best practices that payment providers can leverage to develop a successful B2B payments strategy.

First, address pain points through smart technology. This is a strategic approach rather than simply adopting trending technologies. It involves implementing automation to replace inefficient manual processes, optimising workflows for maximum efficiency, and generating substantial cost savings.

Second, develop balanced value propositions. The industry has moved beyond arrangements that primarily benefited buyers. Current market conditions demand equitable solutions that create value for all participants in the payment chain. Organisations maintaining outdated, imbalanced models are experiencing significant market share erosion.

Third, create partnerships for stronger value propositions. Corporate expectations now extend well beyond core offerings. Strategic partnerships have become essential components of comprehensive solution delivery rather than optional enhancements.

Fourth, build modular, flexible, end-to-end solutions. System integration capabilities and solution flexibility represent non-negotiable requirements. Corporate clients seek solutions that seamlessly integrate with existing infrastructure while addressing specific organisational needs.

Fifth, leverage indirect sales channels. Market leaders actively develop strategic commercial relationships that substantially expand market reach and visibility. Exclusively direct distribution approaches cannot match the market penetration achieved through effective channel strategies.

Sixth, make integration with existing platforms. This factor significantly influences corporate adoption decisions. Successful implementations minimise resource requirements, implementation timelines, and operational disruption. Integration simplicity directly correlates with adoption rates.

Seventh, quantify the benefits of investment. Imprecise value propositions fail to resonate with decision makers. Detailed ROI calculations facilitate internal approval processes and clearly differentiate serious market contenders from less competitive alternatives. Quantifiable outcomes drive purchasing decisions.

“The digitalisation of B2B processes and payments offers significant opportunities for corporates and other stakeholders in the B2B payments value chain. The B2B payments market is undergoing significant changes, driven by substantial investments and the level of innovation of new digital solutions,” summarises Greg Toussaint, Director at Edgar, Dunn & Company.

While the global B2B payments market continues its trajectory toward $137 trillion by 2027, it will be on payment providers to understand the challenges and adopt solutions that can position them competitively among their peers.

Access the research report here.

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.