VIDEO | What is trace:original? What is the digital envelope?

Patrik Zekkar

Jun 25, 2025

Deepesh Patel

Jun 23, 2025

Deepesh Patel

Jun 23, 2025

At the 57th Annual Meeting of FCI, held in Rio de Janeiro this week, Cristiane Quartaroli, Chief Economist at Ouribank, delivered a keynote exploring Brazil’s economic trajectory in the context of global volatility and domestic structural reform.

Her remarks emphasised the dual narrative facing Latin America’s largest economy: a resilient consumer base and digital leadership on one side, and persistent inflation, fiscal rigidity, and elevated interest rates on the other.

Brazil’s domestic demand continues to underpin its economic activity. Household consumption accounts for a substantial portion of GDP and has demonstrated consistency across business cycles. Urbanisation, digital adoption, and a growing middle class have reinforced this trend.

Retail and financial services in Brazil are increasingly underpinned by digital infrastructure. According to Quartaroli, the widespread use of Pix, a real-time payment system introduced by the Central Bank, has surpassed 60% monthly user penetration. The recent rollout of automatic recurring payments marks another step in the country’s efforts to reduce friction in its payment ecosystem.

Brazil also maintains one of the highest banking penetration rates among emerging markets, with over 90% of the population holding a bank account. This has enabled broader access to digital financial services and facilitated the scale-up of instant payments.

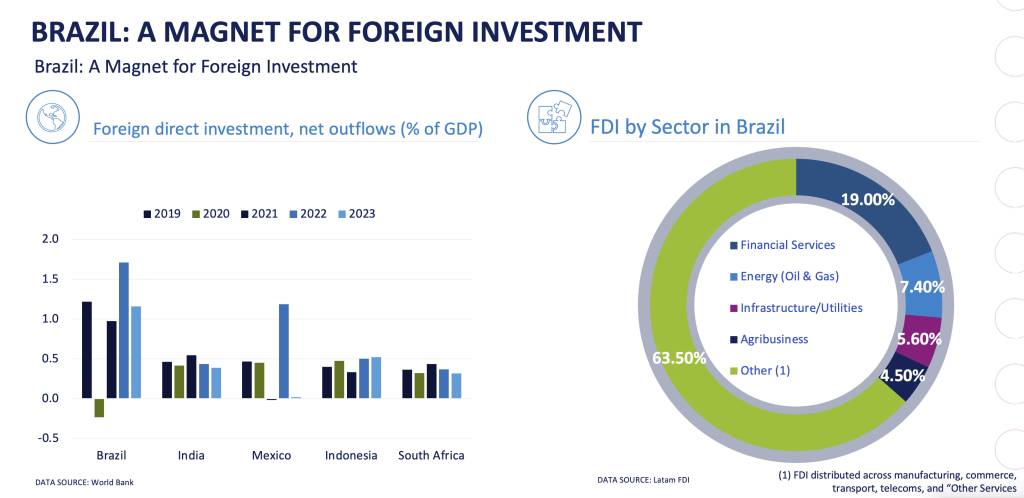

Foreign direct investment (FDI) into Brazil remains comparatively strong. Quartaroli highlighted that Brazil has, in multiple years, outperformed peers such as South Africa, Indonesia, and India in FDI inflows. While commodities continue to play a role, investors are increasingly targeting infrastructure, logistics, healthcare, financial services, and renewable energy.

This diversification signals a shift in investor perception, from a resource-driven economy to a broader platform for long-term growth.

Despite improvements in headline figures, inflation remains above the Central Bank’s official target. Brazil’s Selic rate continues to rank among the highest globally. While this stance has helped contain inflation expectations, it has also weighed on credit conditions, household consumption, and private sector investment.

Comparatively, many emerging economies have already begun monetary easing cycles. Quartaroli noted that Brazil’s delay in joining this trend may undermine competitiveness in attracting capital flows.

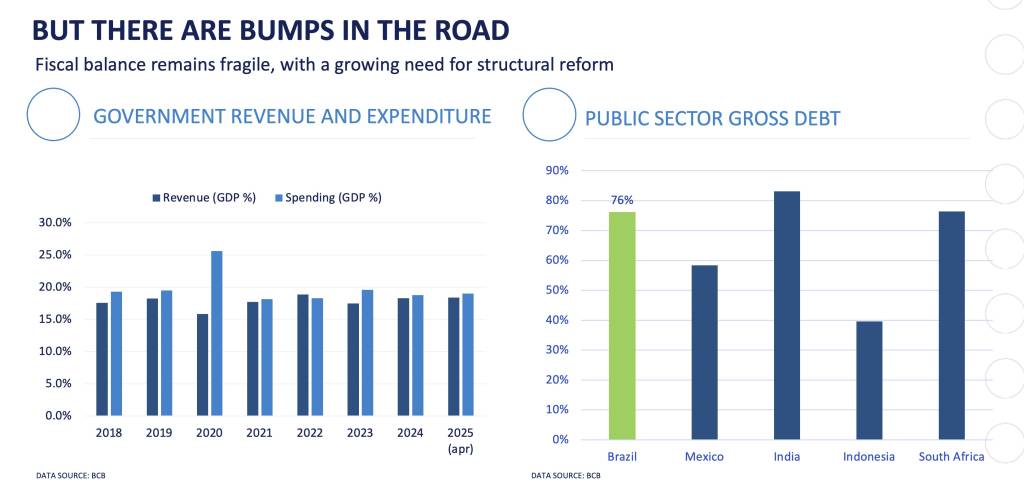

Fiscal rigidity remains a central constraint. Nearly 95% of Brazil’s government expenditure is mandatory by law, with pension liabilities, public sector salaries, and healthcare spending as primary drivers. Public debt hovers at approximately 76% of GDP, notably above the emerging market average.

In 2023, a new fiscal framework was introduced, replacing the previous spending cap. The framework ties federal expenditure growth to 70% of revenue increases and targets a zero primary deficit this year. However, the success of the framework is contingent on the approval of revenue-generating tax measures by Congress. Without these, the credibility of the plan could weaken.

Market participants remain cautious. Discrepancies between official government projections and private sector forecasts for debt and deficit levels persist, and political uncertainty may further complicate fiscal consolidation.

Brazil’s external trade strategy is being reshaped by global developments. Tensions between the United States and China have created opportunities for exporters, particularly in agriculture. Brazil is currently the leading soybean supplier to China and has also recorded increased exports to the U.S. during periods of domestic disruption there.

Quartaroli highlighted this dual exposure as a potential advantage, noting that supply chain reconfigurations may allow Brazil to expand its trade footprint. However, capitalising on these shifts will require coordinated policy, institutional agility, and sustained diplomatic engagement.

Despite macroeconomic headwinds, Brazil’s near-term projections show signs of resilience. Inflation and exchange rate forecasts have improved, and growth estimates for 2025 have been revised upward. Nonetheless, high interest rates, political volatility ahead of the 2026 elections, and ongoing fiscal risks remain key areas of concern.

Quartaroli concluded her remarks by framing Brazil’s economic journey as a process of transformation:

“Training never guarantees victory, but it always builds strength. And in Brazil’s case, we can see the signs: we’re getting stronger, more prepared, and more capable of reaching new heights.”

View the instant premiere on YouTube, here.

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.