SaturnX secures $3 million to scale stablecoin infrastructure for cross-border remittances

Carter Hoffman

Jun 20, 2025

Devanshee Dave

Jun 20, 2025

Devanshee Dave

Jun 20, 2025

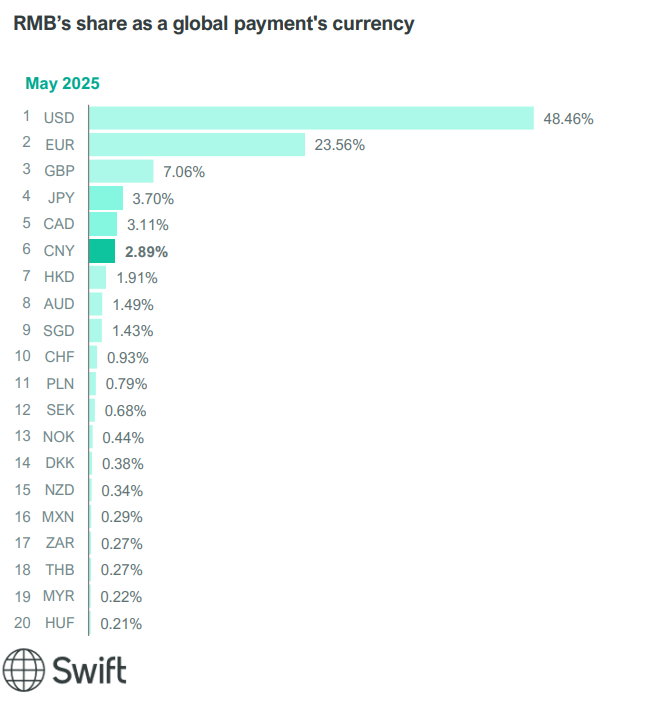

The Chinese renminbi (RMB) has suffered a substantial setback in its internationalisation efforts, according to the latest SWIFT RMB Tracker report released today for the month of May. The currency has dropped one position to become the sixth most active currency for global payments by value, with its market share declining to 2.89%.

The SWIFT RMB Tracker is published monthly and provides statistics on renminbi usage in international payments, trade finance, and foreign exchange markets based on transaction data from more than 11,000 financial institutions across 200 countries and territories.

Data from this report indicates that RMB payments value decreased by 23.07% compared to April 2025, a dramatic decline that far outpaced the general market contraction of 6.81% observed across all payment currencies.

This is a significant reversal in the currency’s international standing. The RMB has now fallen behind the Canadian dollar, which holds 3.11% of global payment share.

The U.S. dollar continues its overwhelming dominance in global payments, commanding 48.46% of all transactions by value. The euro follows at 23.56%, with the British pound (7.06%), Japanese yen (3.70%), and Canadian dollar (3.11%) completing the top five positions.

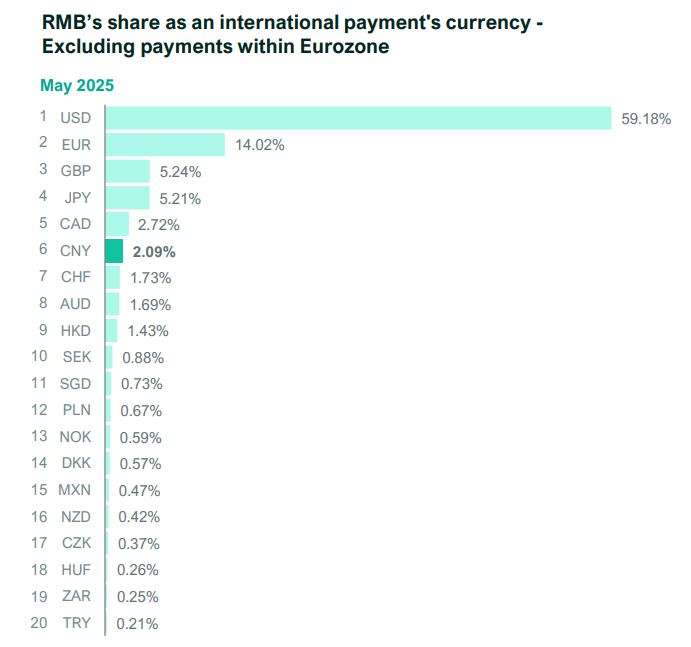

When excluding payments within the Eurozone, the renminbi maintains its sixth position with a 2.09% share of international payments. This metric provides a clearer picture of truly international transactions by removing intra-European payments that might otherwise inflate the euro’s standing.

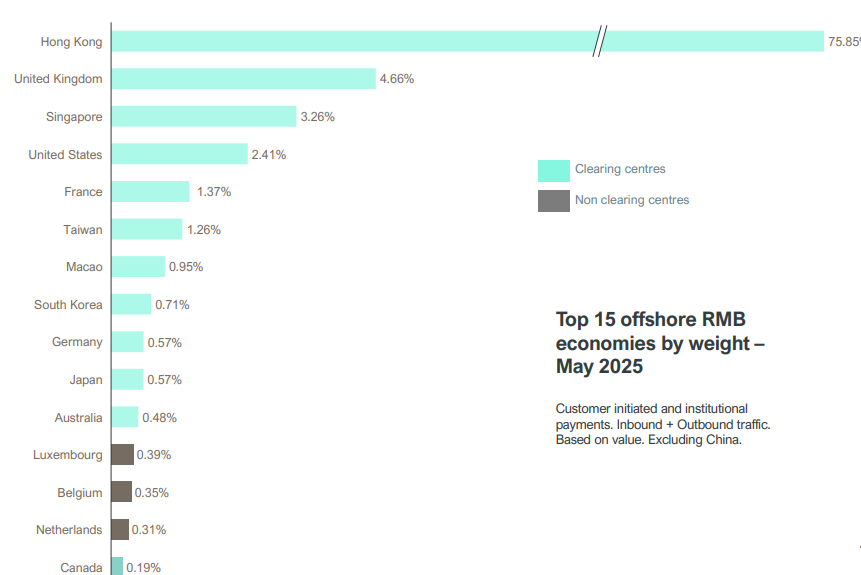

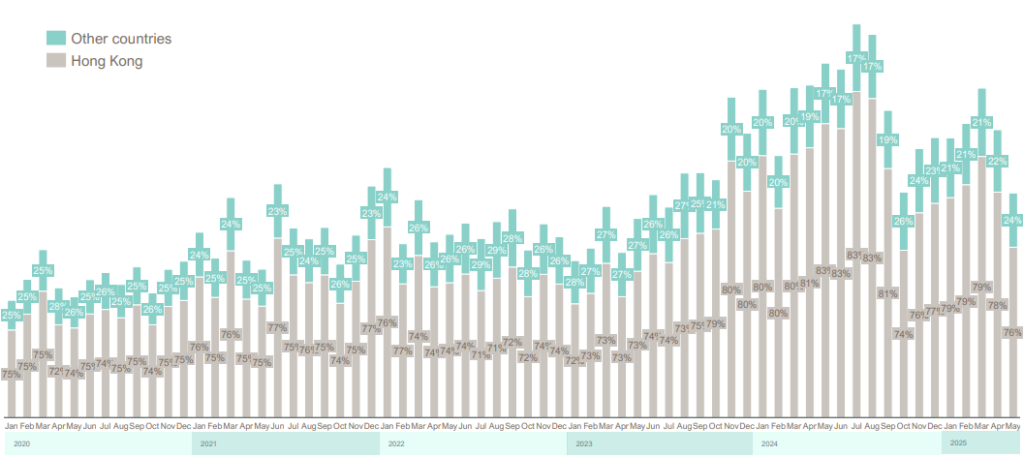

The report reveals Hong Kong’s overwhelming dominance in offshore RMB transactions, processing 75.85% of all activity by value. This concentration has remained relatively stable over the past five years, as shown in SWIFT’s historical data tracking. The United Kingdom (4.66%), Singapore (2.41%), and the United States (0.95%) collectively handle less than 8% of offshore RMB transactions. It is also 16 times more than the nearest competitor, which is the UK.

Hong Kong has consistently maintained a 70-80% share of offshore RMB payments since at least 2020, with only minor fluctuations despite China’s efforts to diversify its currency’s international presence. This shows the RMB’s dependence on Hong Kong as China’s primary financial gateway to international markets.

The historical data also shows a significant concentration of RMB activity in Hong Kong over time, with limited diversification to other financial centres.

This extreme concentration presents a double-edged sword for Beijing. Hong Kong’s established financial infrastructure and special status under the ‘One Country, Two Systems’ framework provide China with a controlled environment for RMB expansion. However, having three-quarters of offshore RMB activity flowing through a single centre creates a significant vulnerability.

Additionally, the current geopolitical condition, including ongoing US-China economic tensions and international scrutiny of Hong Kong’s financial independence, adds another layer of complexity to this critical financial relationship.

The RMB’s current sixth-place position is a marked deterioration from late 2023, when China’s currency briefly achieved fourth place in global payment rankings with a share exceeding 4.6%. The currency’s market share has since experienced a steady decline:

| Period | Global payment share | Global ranking |

| December 2023 | 4.74% | 4th |

| June 2024 | 4.33% | 4th |

| December 2024 | 3.50% | 5th |

| May 2025 | 2.89% | 6th |

The RMB’s downward spiral in global payments stands in marked contrast to its steadier performance in specialised financial sectors.

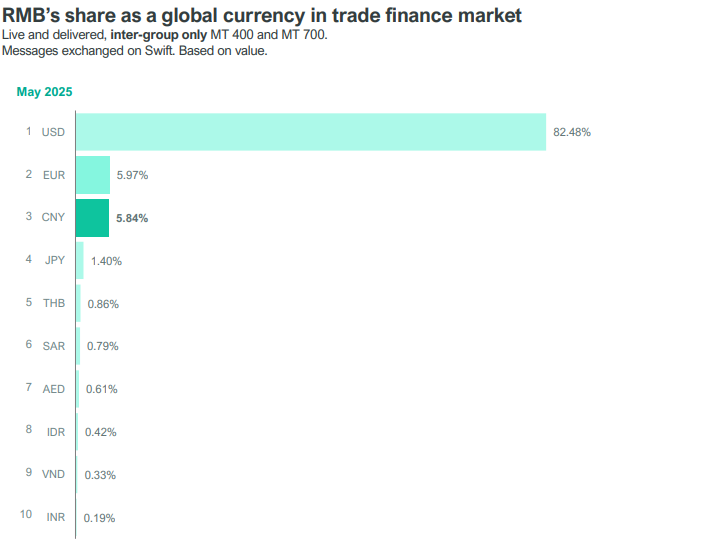

In the trade finance sector, the Chinese currency maintains its position as the eighth most utilised currency with a 5.84% share. However, even in trade finance, the gap with market leaders remains substantial. The U.S. dollar dominates with an overwhelming 82.48% share, followed by the euro at 5.97%.

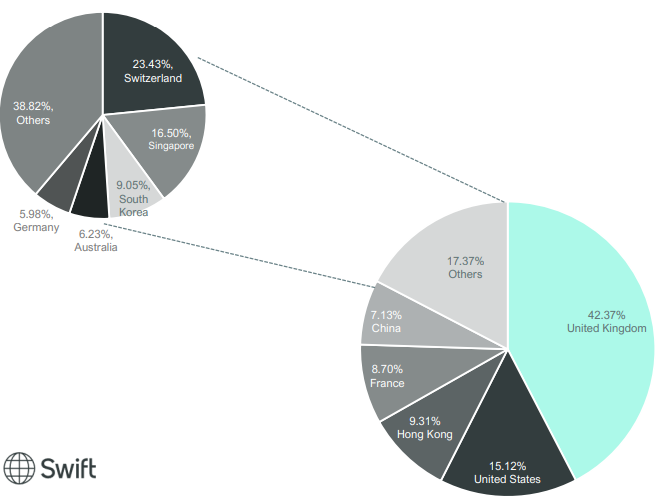

In foreign exchange markets, the RMB exhibits greater stability, maintaining its fifth position globally in spot transactions despite its retreat in general payments. Notably, the United Kingdom processes 42.37% of all RMB FX spot transactions, followed by the United States (15.12%) and Hong Kong (9.31%).

The continued regression in the RMB’s international usage comes at a challenging time for Chinese economic planners, who have long sought to establish the currency as a viable alternative to the U.S. dollar in global trade and finance. Without significant policy adjustments or improved international economic conditions, the RMB may struggle to regain its previous momentum. However, only time can tell what the future holds.

You can access this report here.

Carter Hoffman

Jun 20, 2025

Carter Hoffman

Jun 20, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.