VIDEO | What is trace:original? What is the digital envelope?

Patrik Zekkar

Jun 25, 2025

Deepesh Patel

Jun 21, 2025

Deepesh Patel

Jun 21, 2025

Against a backdrop of uneven economic recovery and supply chain fragmentation, we saw a recalibration of global trade in 2024 that included the factoring industry extending its global reach.

Following the launch of the preliminary statistics in May, and ahead of its 57th Annual Meeting in Rio de Janeiro, Brazil, the newly released FCI Annual Review 2025 offers a comprehensive window into the state of global factoring. It documents not only headline growth figures but also regional shifts, technological adoption, and regulatory developments that are reshaping the landscape of open account trade finance.

Factoring, once widely considered to be a niche working capital tool, has matured into a more flexible, technology-enabled solution, particularly for small and medium-sized enterprises (SMEs) seeking liquidity in a risk-conscious world and the FCI report helps to document this evolution.

Below, we unpack some of the report’s major themes, offering a teaser of the data and insights within.

Global factoring volumes reached €3.66 trillion in 2024 (up 3.6% from the previous year). While modest in absolute terms, this growth outpaced overall global trade growth (which increased by only 2% according to UNCTAD), and it represents a steady upward trajectory amid economic conditions that remain far from stable.

Of the total growth, domestic factoring continues to dominate, accounting for €3.11 trillion, or roughly 85% of total volume. Even so, international factoring is growing at a faster clip, rising 4.6% year-on-year to €550 billion. This divergence is partly attributable to the expansion of open account trade, with firms seeing international factoring as a mechanism to mitigate their cross-border risk.

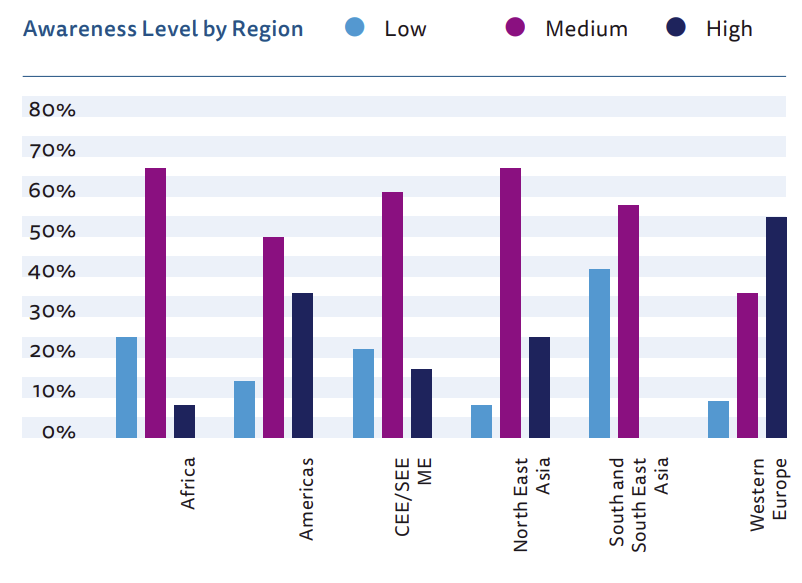

The report attributes this momentum to greater awareness of receivables finance, advances in digital infrastructure, and the increased use of the FCI two-factor system for cross-border trade. In many regions, factoring is the force enabling trade.

While the use of factoring has been expanding globally, the level of growth varies widely among regions.

Europe retains its position as the dominant market, accounting for 66% of global factoring volume, but growth has plateaued, with turnover rising just 1.1% in 2024. Mature markets in Western Europe appear saturated, and regulatory changes (such as Basel III/CRR3 and the proposed Late Payment Regulation) are reshaping the environment for banks and non-bank financial institutions alike. Nevertheless, factoring remains an integral part of the European credit ecosystem, with an 11% penetration rate over GDP.

By contrast, Asia-Pacific was the fastest-growing region in 2024, expanding 9.2% to reach €964 billion. Mainland China remains the anchor market, growing 7% to €679 billion, while India posted an extraordinary 120% increase to €38.2 billion. The levels in Taiwan and Singapore (with 7.5% factoring-to-GDP ratios) are a prime example of how important receivables finance has become for regional supply chains. With 12 of the WTO’s top 30 trading economies located in Asia-Pacific, factoring’s future in the region looks increasingly central.

In the Americas, factoring volume grew by 7.3%, with notable gains in Latin America. Brazil and Mexico led the charge as domestic factoring gained broader traction among SMEs. The United States, while still underpenetrated in factoring terms, showed renewed interest in supply chain finance-linked receivables models. Cross-border factoring through FCI’s Four Corner model accounted for 4.7% of regional volume.

The Middle East and Africa regions showed a combined growth of 6.4%. Morocco and South Africa saw sharp increases, while Egypt and Mauritius posted gains that hint at broader regional appetite. Despite data limitations in the MENA region, anecdotal evidence suggests increased adoption of both payables and receivables finance. FCI’s partnerships with institutions such as Afreximbank and the EBRD are helping to from a regulatory and educational standpoint.

Despite the positive trajectory, structural headwinds remain. Legal fragmentation continues to impede factoring growth in many jurisdictions with several countries still lacking enabling legislation, while others impose debtor consent requirements or prohibit the assignment of receivables, which undermines the legal enforceability at the core of factoring transactions.

Capital requirements also present a persistent challenge. In the EU, ongoing advocacy efforts led by FCI and the EUF have pushed for revision of the Days Past Due treatment under Basel III. Preliminary feedback from the European Banking Authority (EBA) has been encouraging, but final implementation remains pending.

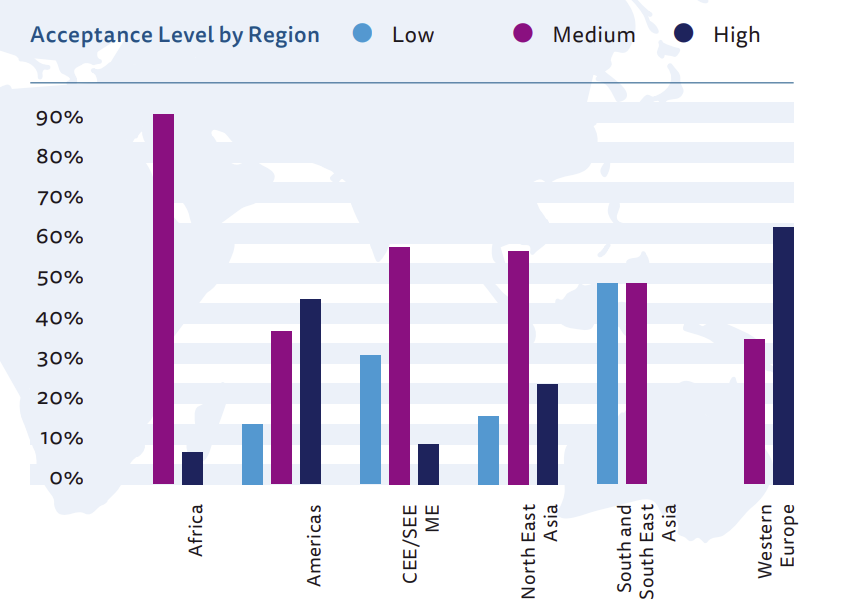

Elsewhere, the lack of credit registries and reliable debtor data continues to limit the scalability of receivables finance, particularly for SMEs and non-bank providers. In many developing markets, factoring remains misunderstood or conflated with debt collection, reinforcing stigma and impeding adoption.

And while technology holds great promise, it is not yet evenly distributed. Digital infrastructure gaps, particularly among SMEs and public-sector entities, constrain the full adoption of e-invoicing and real-time processing in several regions.

Still, the FCI network is actively working to address these issues, whether through policy advocacy, training via the FCI Academy, or collaboration with regional development banks.

The outlook for 2025 is one of cautious confidence. Global economic uncertainty persists – fuelled by geopolitical instability, inflationary pressure, and shifting trade alliances – but the factoring industry is better equipped than ever to respond. The continued expansion of legal frameworks, the acceleration of digitisation, and the diversification of funding models all point to a more mature, more resilient industry.

FCI’s 2025 Annual Review shows that factoring is no longer confined to traditional markets or institutions. In frontier economies, fintech innovators are adopting it as a tool for liquidity and de-risking.

For industry professionals, regulators, and trade financiers alike, the full FCI Annual Review 2025 offers a detailed breakdown of market trends, legal developments, and structural shifts across over 90 countries.

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.