VIDEO | BAFT CEO: Charting the course for transaction banking in a fractured world

Tod Burwell

Jun 06, 2025

Martin Smith

May 26, 2025

Martin Smith

May 26, 2025

Supply chain finance (SCF) is regaining popularity rapidly among Asia Pacific (APAC) Corporate and Commercial enterprises to settle invoices with suppliers providing them with goods and services according to East & Partners proprietary “voice of the customer” analysis.

Large corporates are attracted to the flexibility of extending payment terms to suppliers, giving them more flexibility over invoicing and liquidity at a time of enormous upheaval stemming from the US-China trade war and subsequent uncertainty resulting from erratic tariff changes.

CFOs and corporate treasurers are looking to their bank more than ever for guidance and support to navigate tariff uncertainty. Challenging logistics issues and second order impacts reverberating up and down global supply chains has elevated the importance of knowledgeable relationship managers with dedicated industry experience as working capital management strategies are forced to adapt to evolving market dynamics.

East & Partners long running Australian Trade & Supply Chain Finance service, based on direct interviews with 1,891 importers and exporters market wide across Corporate, Commercial and SME segments, reveals 42 percent of Corporates, 36 percent of Commercials and 29 percent of SMEs use SCF actively, split across Receivables Financing, Inventory Financing, Invoice Finance, Distributor/Buyer Finance, Pre-shipment/PO Finance, Payables Financing and Supplier Financing.

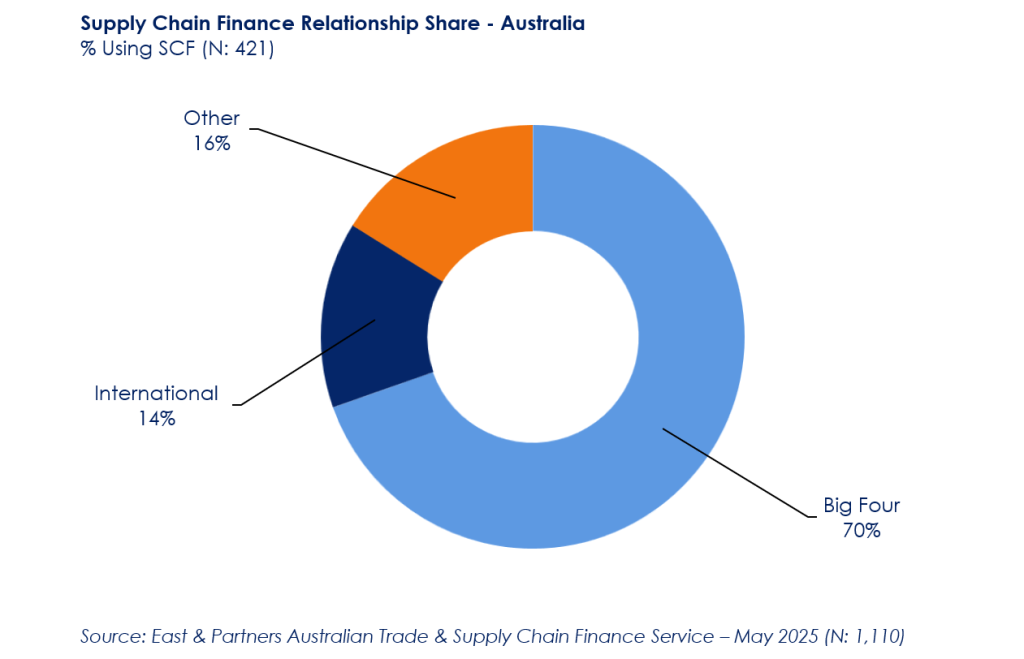

The research also reveals among Commercial and Corporate enterprises that are actively using SCF who they are partnering with among Australian and international banks and what their current and forecast value of SCF facilities is. The Big Four majors cumulatively account for 70 percent of total SCF relationship share. International banks such as HSBC represent 14 percent and “Other” providers including non-bank trade financiers and regional lenders total 16 percent share.

With an average current SCF facility size of A$103.8 million market wide, this figure is forecast to expand strongly by 40 percent in the next year to A$144.9 million. How is this distributed by sector vertical?

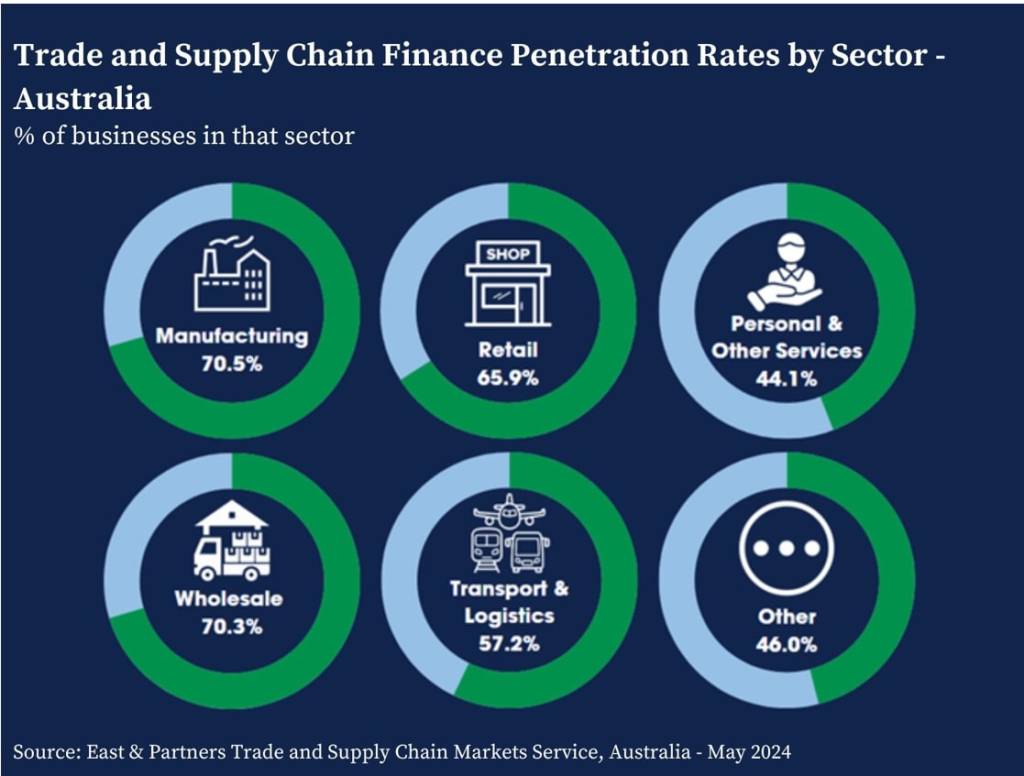

Recent East & Partners research reveals sharp differences in trade and supply chain finance penetration across Australian industries and further afield in the APAC region more broadly.

The Australian manufacturing sector is the most “open” to international trade with 7 in 10 actively importing or exporting (71 percent). This figure rises to 82 percent in Singapore and as high as 85 percent in Hong Kong. In contrast under 57 percent of enterprises in the transport sector exhibit an active need for trade and supply chain finance, close to 50 percent in Singapore and Hong Kong.

Customer retention or “wallet share”, measured as the average percentage share of trade and supply chain business per primary customer, continues to slide as large Asia corporates spread their wallet across multiple providers according to East & Partners Trade and Supply Chain Asia Large Corporate service.

Across the Top 100 revenue ranked corporates in ten countries, average wallet share has dipped to a record low of 37 percent, sliding three percent year-on-year as competition intensifies for trade finance clients.

Major banks rely on East’s proprietary analysis to arm their sector based strategic decision making and unlock new growth. The findings provide a valuable benchmarking analysis at a time of massive upheaval and uncertainty for importers and exporters navigating an uncertain environment.

What factors prevent the 62 percent of Australian Corporates and Commercials from using SCF? Reputational concerns linked to the Greensill collapse have largely abated while historically terms have been viewed as excessively onerous for smaller suppliers (e.g. 120 days plus).

“Is SCF alleviating or exacerbating the ever-growing global trade finance gap that has ballooned beyond US$2.5 trillion according to the Asia Development Bank?” said East & Partners Global Head of Markets Analysis, Martin smith.

“East queried Australian SMEs on their experience as part of a supply chain financing arrangement with a large corporate buyer to gauge sentiment on their participation on these engagements. “

“29 percent of SMEs are actively engaged as part of SCF arrangements with a large corporate buyer. Of those, 43 percent declare their experience is mainly positive, specifically the opportunity to gain access to a reliable revenue stream. 1 in 4 are neutral (25 percent), finding there are no discernible differences with standard buyer terms incorporating traditional trade finance methods such as Letters of Credit (LCs) or Documentary Bills for Collections (DCs).”

“Very few SMEs were characterized by a negative view resulting from an over reliance on a single major buyer (6 percent) with many unable to form a coherent view yet because it is too early to tell (26 percent).”

“The research also reveals SMEs are struggling to digitise their trade and supply chain financing operations which may have an adverse impact on the global shortfall in access to trade finance contributing to the growing trade finance gap. Australian SMEs have digitised a mere five percent of their trade finance volumes compared to large Corporates achieving eight times more progress by digitising over 40 percent of their volumes.”

“What is holding them back? A combination of factors is limiting progress on trade finance digitisation, including a lack of understanding of new solutions, perceived inhibitive cost of set-up, unclear automation benefits and a lack of guidance from their primary trade finance provider.”

Tod Burwell

Jun 06, 2025

Carter Hoffman

Jun 06, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.