Tide implements API-first treasury solution in partnership with Atlar to power global expansion

Devanshee Dave

Jul 01, 2025

Devanshee Dave

May 13, 2025

Devanshee Dave

May 13, 2025

Estimated reading time: 8 minutes

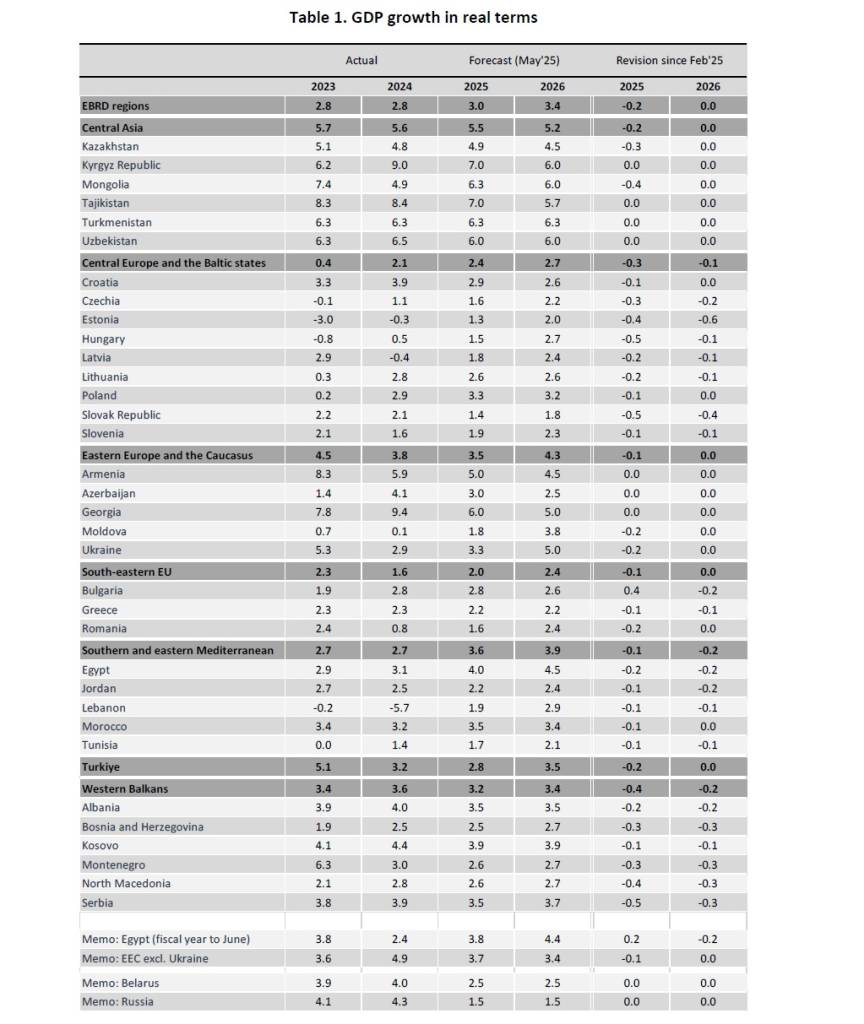

Economic growth across the European Bank for Reconstruction and Development (EBRD) regions slash to 2.8% in 2024, unchanged from 2023 but down from 3.4% in 2022. This slowdown reflects weak external demand, especially from advanced Europe, and continued growth divergence between the European Union and the United States.

Average inflation in the EBRD regions peaked at 17.5% in October 2022 and bottomed out at 5.3% in September 2024 before picking up to 6.1% as of February 2025, more than 1% point above its pre-pandemic average.

EBRD projects growth to reach 3.0% in 2025 and 3.4% in 2026, though these forecasts have been revised downward by 0.2 points for 2025 relative to earlier projections. This downward revision reflects heightened global trade policy uncertainty, weaker external demand, and the direct and indirect impacts of recently announced increases in US import tariffs.

Across EBRD regions, performance varies substantially. Central Asia continues to show robust growth at 5.5% projected for 2025, while the Western Balkans is expected to grow at 3.2%. Growth in central Europe and the Baltic states is forecast at 2.4% in 2025, hampered by slowing European demand and new trade barriers.

Source: Eurostat for EU economies, national authorities and EBRD. Note: Weights are based on the values of gross domestic product in 2022 at market exchange rates. The table also includes forecasts for Belarus and Russia notwithstanding the fact that Belarus and Russia have had their access to Bank resources suspended under Article 8.3 of the Agreements Establishing the EBRD.

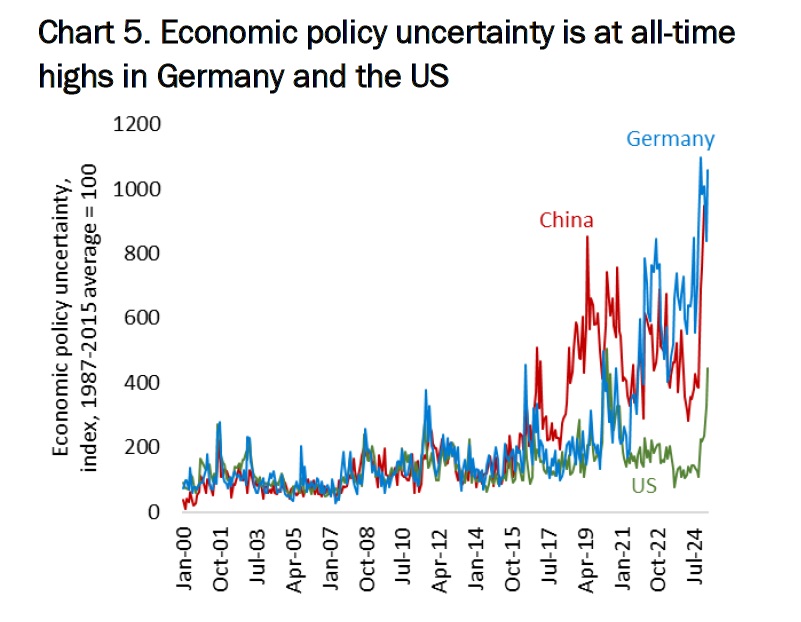

Trade and economic policy uncertainty has risen sharply in 2025, reflecting unknowns surrounding potential increases in tariffs on US imports and reciprocal measures by US trade partners.

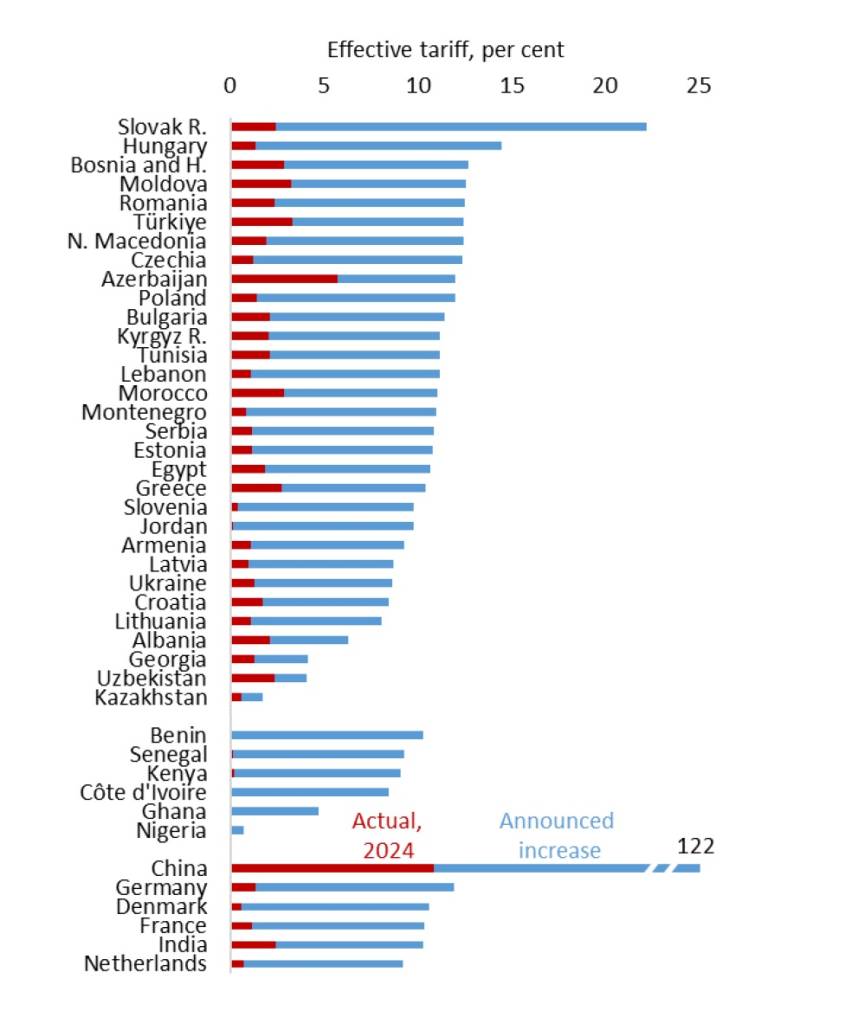

Recent US tariff increases include 25% tariffs on steel, aluminium, and cars, as well as a 10% increase in blanket tariffs for most economies. These new tariffs are expected to push the average effective US tariff on imports from EBRD regions from 1.8% in 2024 to 10.5% (based on 2024 trade composition). Measures of policy uncertainty are at all-time highs in the US and Germany, with negative implications for investment and production.

Source: United States International Trade Commission (USITC), UN COMTRADE, White House and authors’ calculations.

Note: For 2024, the effective US tariff is calculated as import duties collected by the US in 2024 divided by total imports

In EBRD regions, the largest direct negative impact of tariff increases on GDP is estimated for the Slovak Republic (0.8% of GDP), Jordan (0.6% ), and Hungary (0.4% ). For the Slovak Republic and Hungary, the automotive sector is particularly vulnerable, with car tariffs accounting for 83% of the overall effect in the Slovak Republic and 41% in Hungary.

These effects are likely to ripple through global value chains, affecting economies with limited direct exports to the US. While some economies may benefit from trade diversion due to relative changes in tariff rates, particularly vis-à-vis China, the net effect is expected to be negative for most EBRD countries.

Here is what the report says about regional growth.

Central Asian countries continue to showcase strong economic performance, with growth expected at 5.5% in 2025 and 5.2% in 2026, driven by domestic demand, including public investment, rising real wages, and sustained remittance inflows. However, commodity-exporting economies may face pressure on their external accounts due to global price volatility.

Kazakhstan’s economy is projected to grow by 4.9% in 2025 and 4.5% in 2026, supported by increased oil production from the expanded Tengiz oilfield. Mongolia’s high dependence on commodity exports to China (over 90% of total exports) creates significant uncertainty for its export dynamics, though growth is still expected at 6.3% in 2025.

Growth in central Europe and the Baltic states picked up from 0.4% in 2023 to 2.1% in 2024 as economies gradually adjusted to lower Russian gas supply and higher energy prices. Growth is expected at 2.4% in 2025 and 2.7% in 2026, with downward revisions reflecting the impact of new tariffs and increased global policy uncertainty.

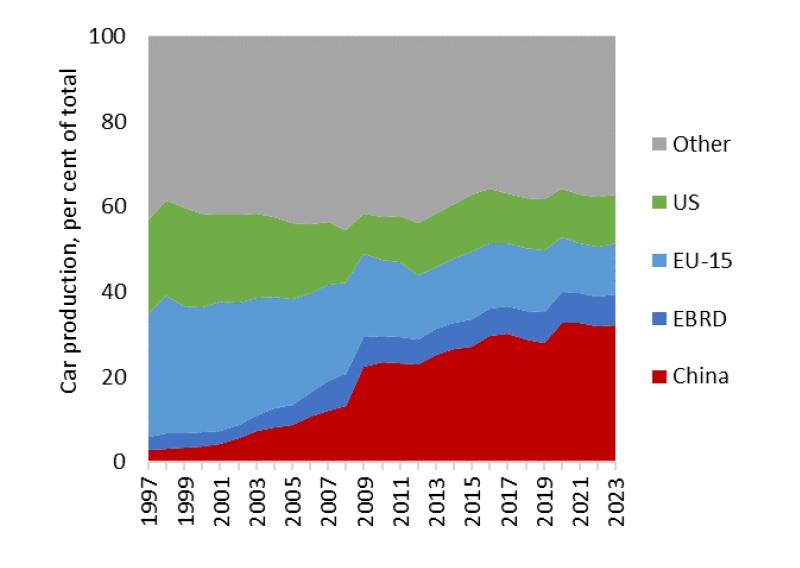

The Slovak Republic faces the greatest challenges from US tariffs due to its heavy reliance on car exports.

As the global leader in car production per capita (with 182 cars produced per 1,000 inhabitants last year), Slovakia will likely be the hardest hit by increased US tariffs among EU economies, especially with China’s significant growth. Real GDP growth is expected to decelerate sharply to 1.4% in 2025.

Source: CEIC, International Organization of Motor Vehicle Manufacturers and authors’ calculations.

In eastern Europe and the Caucasus, growth slowed from 4.5% in 2023 to 3.8% in 2024 as the boost from intermediated trade and inflows of labour and capital to the economies of the Caucasus waned. Growth is expected to moderate further to 3.5% in 2025 before picking up to 4.3% in 2026.

Ukraine’s economy expanded by 2.9% in 2024, despite electricity shortages, weak harvests, and acute labour shortages. Growth is forecast at 3.3% in 2025, assuming continued external financing from the EU and G7 countries. However, Russian attacks on Ukraine’s energy infrastructure continue to weigh on economic activity.

Growth in the southern and eastern Mediterranean is expected to pick up from 2.7% in 2023 and 2024 to 3.6% in 2025 and 3.9% in 2026. However, forecasts have been revised down relative to earlier projections, reflecting the impact of conflicts (through trade and confidence channels) and increased global policy uncertainty.

In Egypt, output growth is expected to increase from 2.4% in fiscal year 2024 to 3.8% in FY25 and 4.4% in FY26. Jordan faces significant challenges from US tariff policies, particularly as exports to the US account for 5.7% of its GDP, primarily in textiles and jewellery.

In Turkey, growth reduced from 5.1% in 2023 to 3.2% in 2024 due to a tighter monetary policy to bring down persistently high inflation. Growth is expected to be 2.8% in 2025 before picking up to 3.5% in 2026. The downward revision for 2025 reflects lower domestic and external demand and tighter-than-expected monetary policy.

Growth in the Western Balkans is expected to slump from 3.6% in 2024 to 3.2% in 2025 and 3.4% in 2026. Downward revisions reflect spillovers from sluggish growth in advanced Europe as well as political instability in Serbia.

Economies with strong export-oriented manufacturing sectors, such as Bosnia and Herzegovina, North Macedonia, and Serbia, face significant indirect negative effects through their exports to the eurozone. Tourism-dependent economies like Kosovo, Albania, and Montenegro may experience more moderate impacts.

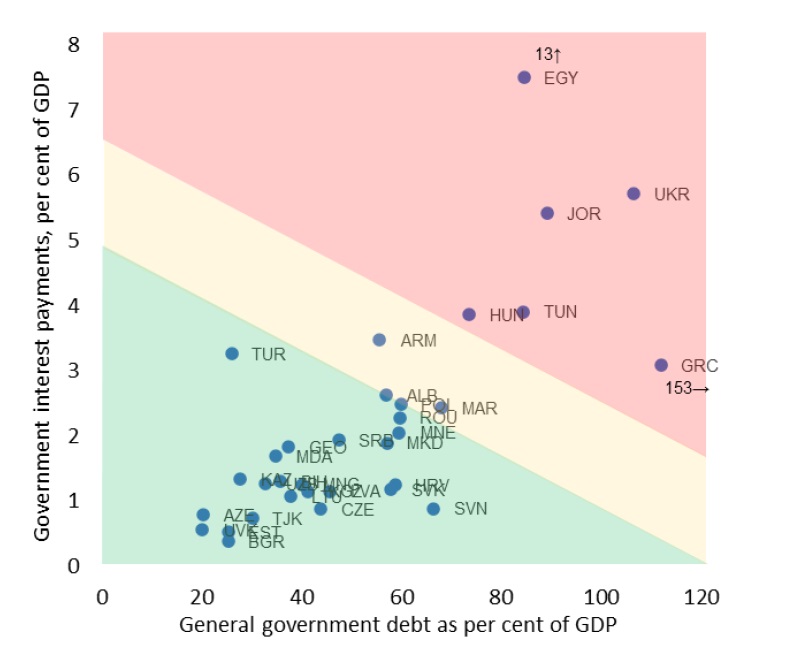

Despite substantial fiscal pressures, the IMF expects average debt in the EBRD regions to remain stable at around 52% of GDP over the period 2025-29.

Additionally, significant fiscal vulnerabilities remain in a number of economies, characterised by high government interest payments as a share of GDP and/or high public debt as a share of GDP. These are expected to be highest in Egypt (with interest payments of 13% of GDP), Ukraine, Jordan, Tunisia, Hungary, and Greece.

Source: IMF World Economic Outlook October 2024 and authors’ calculations.

Note: IMF projections for 2025. Data not available for Lebanon.

Increased geopolitical tensions have prompted many economies in the EBRD regions and beyond to ramp up their defence spending. Between 2014 and 2023, defence expenditure in the EBRD regions nearly doubled from around 1.8% of GDP to approximately 3.5% (2.4% of GDP excluding Ukraine).

Analysis suggests that a 10% increase in demand for defence-related products from the EEA, UK, and Ukraine, equivalent to roughly US$170 billion, could raise global output by an estimated 0.2%.

Economies across the EBRD regions are navigating a perfect storm of challenges, from US tariff hikes to rising inflation and fiscal pressures.

The difference between merely weathering these headwinds and actually thriving may well come down to each country’s ability to transform defence investments into broader innovation while maintaining fiscal discipline amid mounting pressure to spend.

You can read the full report here.

Devanshee Dave

Jul 01, 2025

Carter Hoffman

Jul 01, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.