VIDEO | Using digitalisation to navigate macro challenges in trade finance

Jul 01, 2025

Dominic Capolongo

Maxim Neshcheret

Jul 01, 2025

Maxim Neshcheret

Jul 01, 2025

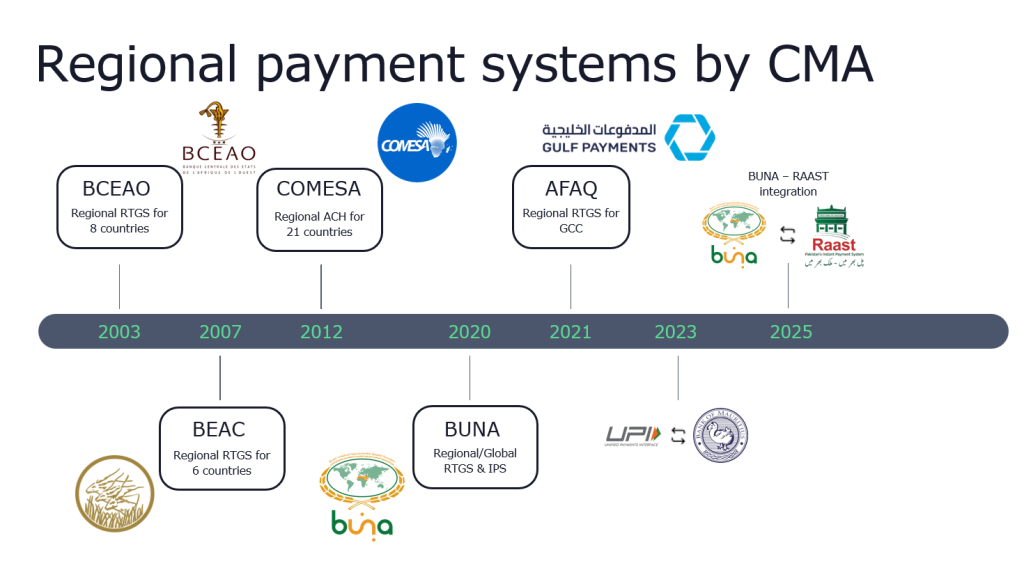

As global trade realigns under shifting geopolitical and economic forces, the payment infrastructure that supports it is evolving rapidly. For decades, cross-border payments were anchored in USD-denominated correspondent banking networks. Today, however, regional blocs across Africa, the Middle East, Asia, Europe, and Latin America are building sovereign payment systems that promote the use of local currencies, reduce friction, and expand financial inclusion.

These initiatives represent more than technological upgrades. They are part of a broader global movement to rebalance control over financial systems, enhance resilience, and increase autonomy in the face of external shocks.

Let’s examine the approaches being taken by different regions around the world, consider commonalities and look ahead at what the future holds.

Africa is advancing in payment integration through initiatives like the Pan-African Payment and Settlement System (PAPSS), launched under the AfCFTA. While PAPSS provides a critical framework for cross-border payments, its current USD-based clearing mechanism limits its full potential for local currency usage.

In parallel, regional blocs such as COMESA are working on practical solutions for local currency settlement that better reflect regional trade flows. The East African Community (EAC) is progressing towards a shared regional currency, with recent updates indicating renewed political commitment and institutional preparation.

The Middle East has developed robust infrastructure through initiatives such as BUNA, a cross-border payment platform operated by the Arab Monetary Fund. BUNA enables settlement in both regional and global currencies and serves commercial and central banks alike.

In the Gulf, the AFAQ system has been operational for several years, facilitating real-time payments in national currencies among GCC member states. Together, BUNA and AFAQ represent a growing regional ecosystem that is technically advanced and politically aligned with national objectives.

Asia has embraced an interconnection model for its domestic payment systems. What began as an initiative at the BIS Innovation Hub is now being executed by the independent organisation Nexus Global Payments (NGP). The project will connect national instant payment systems across borders to enable seamless and affordable retail transactions.

Central banks from India, Singapore, Thailand, Malaysia, and the Philippines are among the key participants. Nexus Global will link platforms like UPI, PayNow, and DuitNow, allowing real-time payments across countries using only mobile numbers or aliases. The initiative avoids building a central clearinghouse, relying instead on synchronised protocols that support interoperability and local control.

Europe is reasserting its strategic position through public infrastructure and regulatory reform. The TARGET Instant Payment Settlement (TIPS) system allows real-time settlement of euro-denominated payments across SEPA. Recently, the European Payments Initiative (EPI) announced a collaboration with Europa, a public-private effort to create a pan-European payments brand.

The goal is to deliver interoperable wallets and merchant services that reduce dependence on non-European providers. Backed by regulatory clarity from the Markets in Crypto-Assets (MiCA) framework and mandates requiring instant payment access across the eurozone by 2025, the EU is building a coordinated and sovereign digital payment infrastructure.

In Latin America, Brazil’s PIX system has set a new benchmark. Developed by the Central Bank of Brazil, PIX has enabled instant, 24/7 payments across the country. Its success has prompted discussions on replicating or interlinking the system with other nations in the region.

Chile, Colombia, and Argentina are among the countries expressing interest. Industry associations are also calling for harmonised infrastructure that could support a regional real-time payment corridor, especially for remittances and SME trade.

These regional systems are not expected to remain siloed. Their next phase of evolution will involve interconnecting with one another, creating global corridors that bypass traditional USD-settled infrastructure. Projects like Nexus Global could connect to platforms such as BUNA or TIPS, building bridges between regions.

Legacy institutions such as SWIFT, Visa, and Mastercard are responding to this momentum. They are seeking to integrate their services with sovereign payment systems, offering value-added capabilities or backend support. However, their role as central infrastructure providers may decline as countries prioritise self-managed, locally governed ecosystems.

Stablecoins are also gaining ground as a complement to public payment systems. When issued by licensed Electronic Money Institutions and backed by fiat reserves, euro- and local currency-denominated stablecoins can offer real-time settlement and programmable features.

While not central bank-issued and therefore not classified as M0, stablecoins mimic some characteristics of physical cash or M1 money. They are increasingly used in wallet-based solutions for retail, remittances, and merchant payments, particularly in markets lacking advanced national infrastructure.

MiCA in the EU and similar proposals in the US are accelerating stablecoins’ regulatory acceptance. As these frameworks mature, stablecoins are likely to become part of the core digital money landscape in both advanced and emerging economies.

Cross-border payments are entering a new era defined by regional sovereignty, digital innovation, and greater collaboration. Regional payment systems like BUNA, Nexus Global, and AFAQ are replacing legacy architectures with faster, cheaper, and more inclusive platforms.

These systems are designed not just to serve their own regions, but increasingly to connect with one another, forming a global mesh of trusted financial rails. Their expansion will challenge the historical dominance of centralised, Western-led financial networks.

Stablecoins and regulatory advancements add another layer to this transformation, offering flexibility and programmability to both private and public actors. As these trends converge, synchronisation and harmonisation of regulations and technical standards will be vital. Without them, new silos could emerge, undermining the benefits of interoperability and scale.

The future of payments will not be governed by one model, but by many working in concert. For regulators, technology providers, and financial institutions, the opportunity now lies in shaping this networked future with a clear focus on resilience, inclusion, and sovereignty.

The rise of regional payment systems is set to reshape how cross-border trade and financial operations are conducted. However, the impact will not be uniform across all market participants. In the near term, large corporates operating within established trade corridors may experience limited change. These firms already benefit from structured treasury networks and long-standing correspondent relationships. By contrast, the most immediate and tangible benefits are expected to emerge for individuals, micro-enterprises, and small to medium-sized businesses. For these groups, the availability of cross-border payments that are faster, cheaper, and settled in national currencies could be transformative.

Eliminating the delays associated with batch-based systems and working-hour constraints has important consequences for treasury operations, particularly in liquidity management. If payments can be initiated and received 24×7, treasurers must rethink how they manage cash positions in real time, across multiple accounts and jurisdictions. The traditional reliance on next-day settlement forecasts will gradually be replaced by tools that provide immediate visibility over inflows and outflows, supporting dynamic decision-making.

The growing use of local currencies for settlement is another structural shift, reducing the need to pre-fund foreign currency accounts or hedge extensively against USD volatility. This will enhance working capital efficiency and help support bilateral trade within regional blocs. For many treasurers, especially in emerging markets, this will reduce dependence on hard-currency liquidity buffers that can be costly or inaccessible.

Moreover, these systems often embed data-rich messaging and programmability features, which allow for enhanced reconciliation, automated compliance, and better integration into enterprise resource planning (ERP) systems. The result will be a treasury environment that is faster, leaner, and more responsive.

In the long run, regional payment systems will not only improve the mechanics of cross-border trade but also catalyse broader economic growth. By facilitating access to affordable financial infrastructure, they will enable more inclusive participation in regional value chains and stimulate intra-regional commerce.

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.