The Prax Group story: From too big to fail to collapsing like a house of cards

Devanshee Dave

Jul 05, 2025

Devanshee Dave

Jul 02, 2025

Devanshee Dave

Jul 02, 2025

In today’s time marked by geopolitical tensions and economic uncertainties, the digital economy emerges as both an opportunity and a reflection of growing inequality, according to the World Investment Report 2025, titled “International Investment in the Digital Economy,” released by the UNCTAD. The report was launched by United Nations Secretary-General António Guterres during the Fourth International Conference on Financing for Development (FFD4).

The report paints a troubling picture of rising investment barriers and retreating globalisation, and provides an analysis of global investment flows with particular attention to the rapidly evolving digital sector.

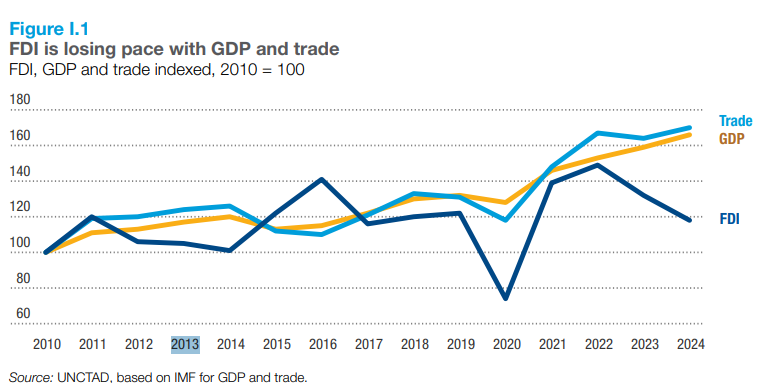

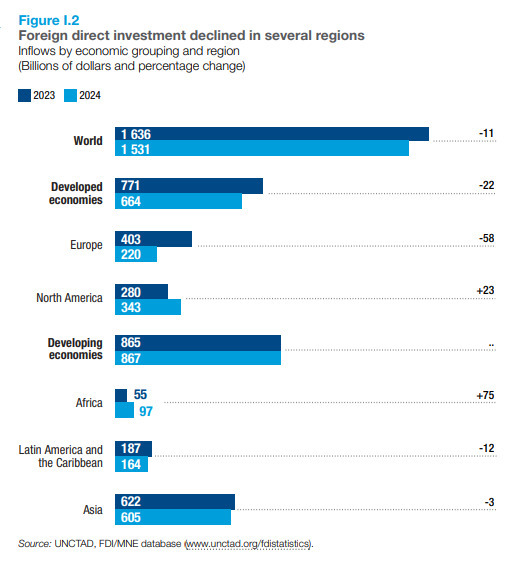

According to the report, global foreign direct investment (FDI) fell by 11% in 2024, totalling approximately $1.51 trillion. This represents the second consecutive year of decline, raising significant concerns about the trajectory of international investment. Infrastructure investment is slowing across most sectors, industrial investment remains under strain, and developing countries are increasingly left behind in the race for capital.

As United Nations Secretary-General António Guterres notes in the preface, “At a time when the world should be deepening cooperation and expanding opportunity, we are seeing the opposite. Barriers are rising. Globalisation is retreating. And the consequences for sustainable development are profound”.

This deterioration occurs against a backdrop of rising trade tensions, policy uncertainty, and geopolitical divisions that further darken the investment environment. The report indicates that the outlook for global FDI in 2025 is negative, primarily due to escalating economic and policy uncertainties, including the potential emergence of a new tariff war.

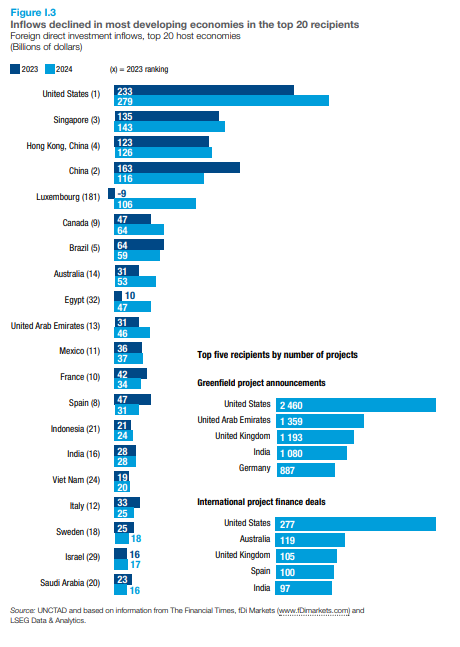

North America recorded rising investment levels, contrasting sharply with substantial declines in Europe. Among developing regions, FDI flows remained essentially flat, though with significant internal variation. Africa and South-East Asia saw notable increases, while East Asia and South America experienced declining investment.

Investment concentration remains a persistent challenge. The report reveals that just 10 recipient countries account for three-quarters of all FDI inflows to developing economies. This concentration limits the developmental impact of international investment and widens existing gaps between economies.

The digital economy represents a significant growth opportunity, with its value in the narrow scope expected to reach $16.5 trillion by 2028, growing at an average annual rate of 7%. This growth trajectory is primarily driven by investment in digital infrastructure such as data centres and cloud services, alongside expansion in ICT exports.

The Report categorises digital multinational enterprises (MNEs) into four major segments:

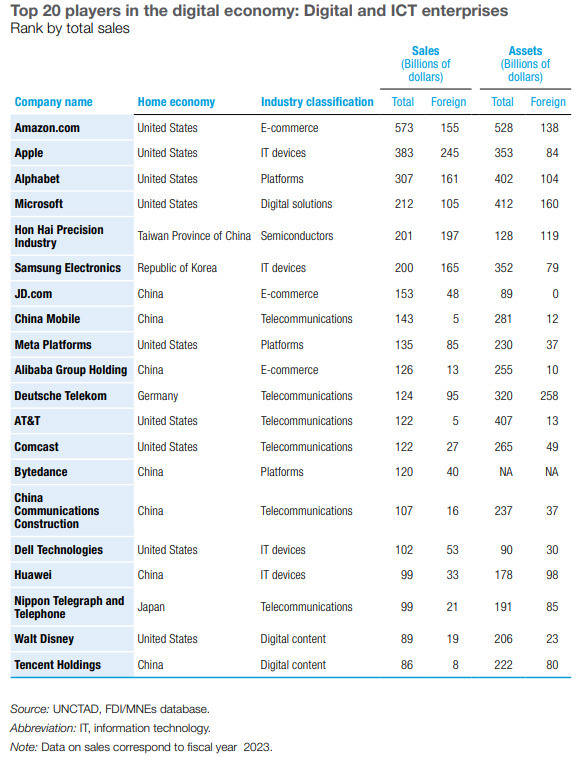

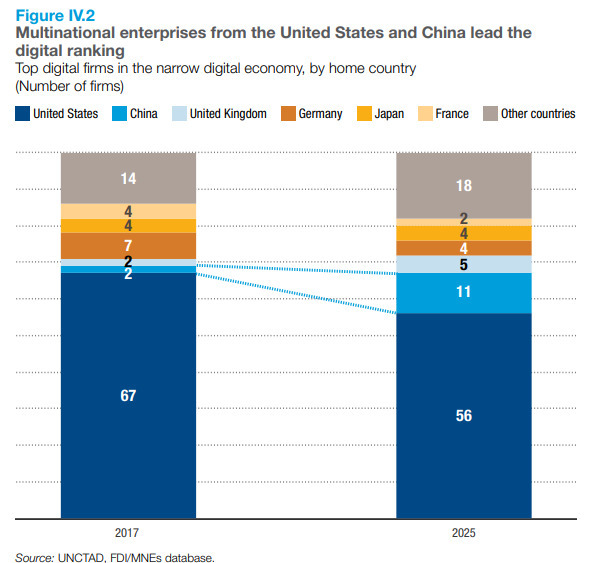

The distribution and market influence of these companies heavily favours developed economies, with 57 of the top 100 digital multinational enterprises headquartered in the United States. Chinese firms continue to gain significant market share, particularly in digital content creation and distribution.

Market concentration within the digital economy has increased dramatically. From 2017 to 2025, the combined share of sales held by the top five digital MNEs more than doubled from 21% to 48%. This concentration raises significant concerns about market power and competitive dynamics.

The report emphasises that significant disparities persist in digital access, usage, capacity, and regulation between developed and developing economies. This digital divide is particularly pronounced among Least Developed Countries (LDCs).

The world faces an estimated $1.6 trillion funding gap to achieve universal digital connectivity by 2030, with the most acute needs in developing countries. The report also highlights several key policy challenges hindering investment flows into the digital economy. This includes a lack of unified strategic approaches, weak governance and regulatory frameworks, limited digital infrastructure, insufficient energy production coupled with unreliable utilities, and persistent shortages of skilled professionals. Additionally, digital infrastructure projects require significant upfront investment and have long construction periods, making them challenging to finance in underserved markets.

Despite these challenges, many developing countries have pioneered innovative approaches to attract digital investment. For instance, Brazil has introduced targeted incentives for artificial intelligence investment, while Chile has developed specific policies to attract data centres. Additionally, countries like Rwanda and Singapore offer specialised support mechanisms for digital startups and angel investors.

By 2024, almost 90% of digital strategies included specific investment facilitation measures, representing a significant increase from fewer than 40% in 2017. These more sophisticated strategies typically define priority sectors, guide complementary policy efforts, identify connectivity potential for underserved regions, and increasingly integrate environmental sustainability considerations.

To close the gap of the digital divide, the report recommends that countries adopt a long-term strategic vision for investment in the digital economy rather than pursuing fragmentary approaches. National digital strategies should articulate a coherent approach that fully incorporates international investment by defining priority sectors, guiding complementary policy efforts in skills development and infrastructure planning, providing key elements to inform investment planning, and integrating environmental considerations.

The World Investment Report 2025 concludes with a call for collaborative action toward a more resilient and sustainable world. The international community must make deliberate decisions to ensure digital No becomes inclusive and sustainable, preventing the next chapter of global investment from simply digitising existing inequalities.

Secretary-General Guterres emphasises: “Now more than ever, we need to work together to chart a course towards a more resilient and sustainable world. The World Investment Report 2025 offers ideas and insights to help do just that”.

If the report recommendations get implemented, it could ensure that international investment in the digital economy contributes to inclusive growth, advancing both the Global Digital Compact and the Sustainable Development Goals.

Read the full report here.

Devanshee Dave

Jul 05, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.