Trade Treasury Payments joins TF COP Task Force as founding partner

Deepesh Patel

Jul 05, 2025

Devanshee Dave

Jul 05, 2025

Devanshee Dave

Jul 05, 2025

On 30th June 2025, Prax Group, owner of Britain’s only domestically-owned oil refinery, collapsed into administration. This sent tremors through the UK energy sector and raised questions about energy security, job stability, and government oversight of critical infrastructure.

Prax Group was built by Winston Soosaipillai and his wife Arani, who began their journey from a single petrol station purchase in 1999 and expanded it into a multinational with billions in revenue and 950+ staff over two decades. However, once a British business success story has now ended in financial turmoil.

The Prax collapse represents a classic case of over-leveraging during expansion. In 2021, Prax acquired the Lindsey oil refinery from French oil giant Total for nearly $170 million. This acquisition more than tripled the group’s revenues to nearly $10 billion but also saddled the company with unsustainable debt. The timing of the acquisition proved particularly unfortunate, coming just before global energy markets experienced unprecedented volatility. The post-pandemic surge in energy demand followed by geopolitical disruptions created a perfect storm of financial pressure on heavily indebted companies.

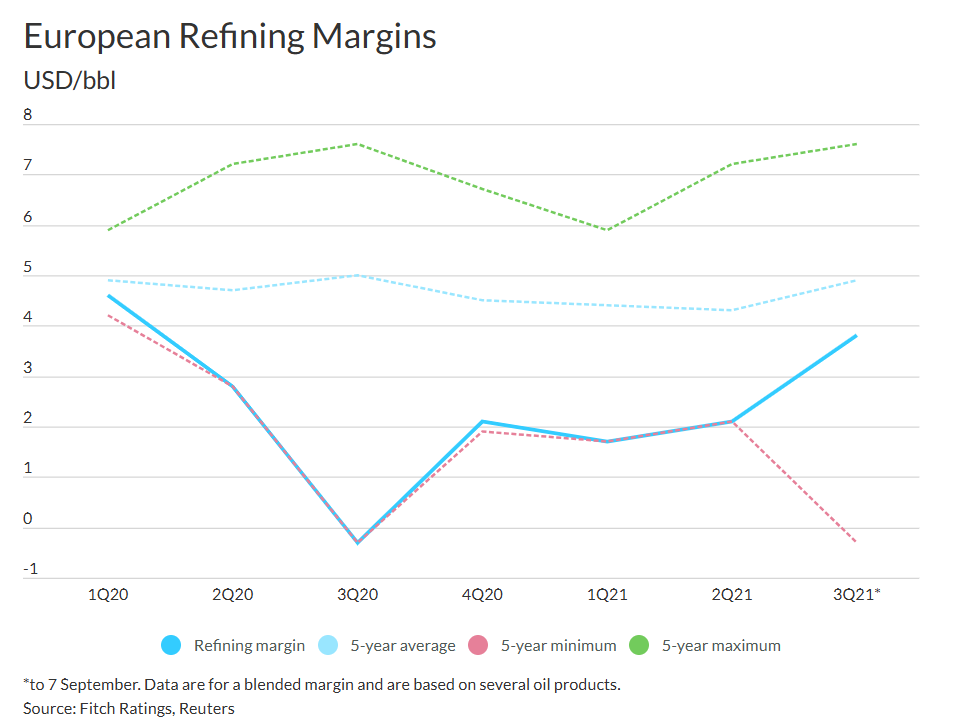

It is to be noted that the refining industry operates on thin margins during the best of times. When Prax acquired Lindsey, European refining margins averaged just $4.53 per barrel.

Source: S&P Global

While these temporarily spiked in 2022 following the Ukraine conflict, they subsequently retreated to historical norms, leaving debt-laden operators vulnerable. Prax essentially bet its future on sustained high refining margins that failed to materialize.

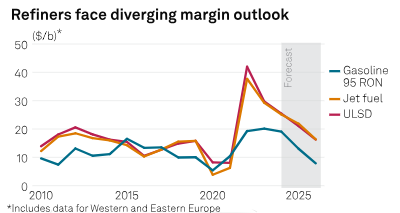

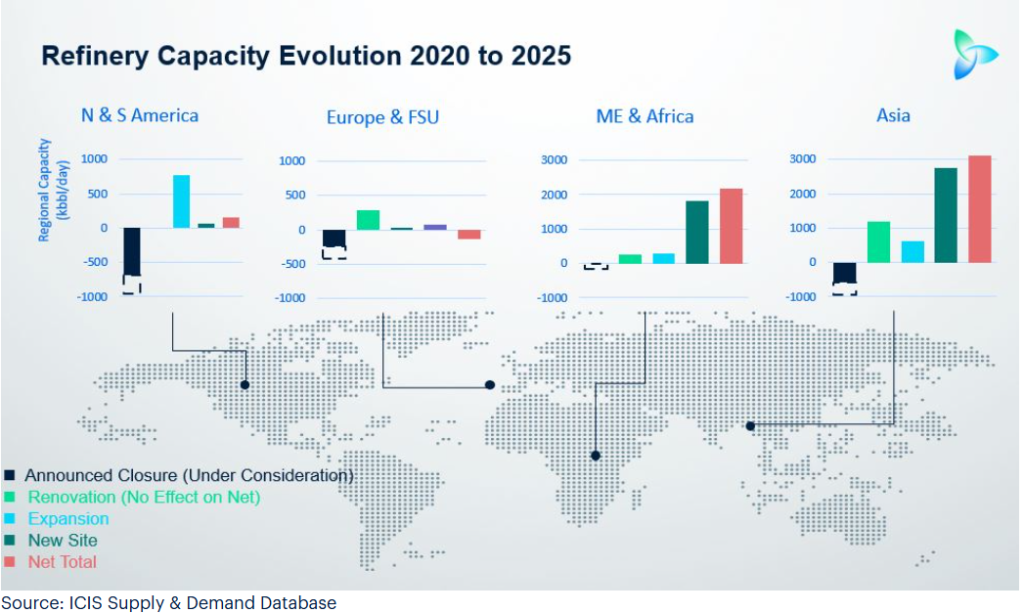

At the same time, the company faced intensifying competition from newer, more efficient mega-refineries in the Middle East and Asia. These facilities enjoy significant advantages in scale, operational costs, and proximity to growing markets, placing further pressure on ageing European refineries.

Amidst this scenario, Prax’s debt kept on piling and as a result, annual interest payments increased from $19 million to $79 million by 2023, surging again to $133 million in 2024, when the company recorded a $75 million loss. Total liabilities had reached $2.3 billion, nearly ten times the level immediately before the Lindsey takeover. The interdependent nature of the group’s divisions meant that financial distress at the refinery spread rapidly throughout the entire organization.

The company’s heavily top-down structure, with Soosaipillai serving as the sole director of both Lindsey and the wider Prax Group, created an environment where even senior staff knew little about company strategy. Information was tightly controlled among a small, close-knit group.

This concentration of power appears to have enabled significant wealth extraction even as the company’s financial situation deteriorated. The duo owners extracted approximately £11.5 million in pay and dividends since the Lindsey acquisition alone.

Perhaps most troublingly, Energy Secretary Ed Miliband reportedly received personal assurances from Soosaipillai as recently as May 13, 2025, that despite some setbacks, the company was not in imminent danger. Within weeks, these assurances had crumbled to dust as the company informed ministers it could not pay its debts, including sums reportedly owed to HM Revenue and Customs that had reached up to £250 million.

With a capacity of 5.4 million tonnes annually, Lindsey oil refinery accounts for nearly 10% of the national refining capacity and supplies everything from petrol forecourts to Heathrow Airport. The facility employs approximately 440 people, with another 180 working at State Oil.

The timing of this collapse is particularly concerning as it came shortly after the closure of the Grangemouth refinery in Scotland earlier this year. The UK’s domestic refining capacity has been steadily eroding, raising questions about the nation’s energy security and increasing dependence on imported fuel. To this, the government’s response has been swift but complex. Glencore, the refinery’s main supplier, initially agreed to provide crude oil for free as a gesture of goodwill while officials searched for a buyer. A deal has since been reached that will see Glencore paid from taxpayer funds to maintain supplies.

As a result, the Prax Group collapse is likely to have immediate and severe consequences for the UK’s energy and transport sectors. Fleet operators across the country are facing potential fuel shortages and price volatility. Harvest Energy, a Prax subsidiary, has warned customers of uncertain times ahead and imposed stringent new payment terms of just three days post-collection or delivery.

For transport companies already struggling with economic pressures, this disruption could lead to increased operational costs, logistical challenges, and potentially higher prices for consumers. The effects could extend throughout supply chains across the UK.

On June 30, 2025, Clare Boardman, Matthew Steven Roe and Paul James Meadows were appointed as Joint Administrators of State Oil Limited and Prax Treasury Limited. Also, Clare Boardman, Paul James Meadows and Christopher Hirst were appointed as Joint Administrators of Prax Petroleum Limited, Harvest Energy Limited and Harvest Energy Aviation Limited. The administration process aims to stabilize these entities while exploring restructuring options or potential sales.

The Official Receiver has been appointed as Liquidator of three additional companies: Prax Lindsey Oil Refinery Limited, Prax Storage Lindsey Limited, and Prax Terminals Killingholme Limited. To assist with this complex process, the Court has appointed Matthew Callaghan, Joanne Hewitt-Schembri, Andrew Johnson, and Sam Ballinger of FTI Consulting LLP as Special Managers.

Clare Boardman has indicated that “options will be considered, including the prospect of a sale for the group’s upstream business and retail operations in the UK and Europe, all of which remain outside of insolvency.” However, the appointment of liquidators for Prax Lindsey Oil Refinery Ltd., Prax Storage Lindsey Ltd., and Prax Terminals Killingholme Ltd. raises the spectre of permanent closure.

If the facility ceases operations entirely, it would not only result in significant job losses but also increase the UK’s reliance on imported fuel, potentially impacting energy security and driving up prices.

The Prax collapse represents more than just the failure of a single company, it highlights structural weaknesses in the UK’s approach to energy security and infrastructure. As domestic refining capacity shrinks, the nation becomes increasingly vulnerable to international supply disruptions and price fluctuations.

For now, hundreds of workers wait anxiously as administrators determine their fate, while motorists and businesses brace for potential disruptions. The coming weeks will reveal whether the Lindsey refinery can be saved or whether this chapter marks another step in the decline of Britain’s domestic energy production capacity.

Trade Treasury Payments

Jul 04, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.