VIDEO | BAFT CEO: Charting the course for transaction banking in a fractured world

Tod Burwell

Jun 06, 2025

Carter Hoffman

Apr 11, 2025

Carter Hoffman

Apr 11, 2025

Small businesses are the undisputed backbone of the global economy. They comprise 90% of the companies in existence globally and employ over half of the world’s working population.

Yet, small businesses often face considerable barriers. Supply chain shocks loom large, geopolitical instability can undermine their efforts, and many struggle to access much-needed financing.

According to a new report from the International Credit Insurance & Surety Association (ICISA), Supporting the economic powerhouse, trade credit insurance (TCI) can be a powerful, albeit often underused, tool to help small- and medium-sized enterprises (SMEs) with these challenges.

The full 17-page report explores these themes in-depth and makes six recommendations to policy-makers to further enable TCI providers to support SMEs.

In the European Union, around 99% of all businesses meet the SME definition, while globally, they account for a staggering 90% of businesses and half of all employment. That alone should signal their strategic importance. But beyond their numbers, SMEs drive innovation, agility, and local economic development in ways that larger corporates often can’t match.

From manufacturing niche components in global supply chains to supporting frontline services like healthcare, education, and logistics, SMEs are everywhere. In 2023, the European Patent Office reported that SMEs and individual inventors were behind 23% of all patent applications originating from Europe. In emerging markets, their contribution runs even deeper. The World Trade Organization estimates that micro, small and medium enterprises (MSMEs) contribute 50% of GDP in developing economies, compared to 35% in developed ones.

Yet despite their value, SMEs remain especially vulnerable in today’s global environment.

The economic shocks of the past few years—COVID-19, inflationary surges, rising interest rates—have disproportionately affected smaller firms. While larger businesses can draw on diversified revenue streams and deeper capital reserves, SMEs tend to operate with far slimmer margins. When interest rates spike or demand contracts, there’s often little room to manoeuvre.

Perhaps the most persistent and wide-reaching challenge is access to finance, and in developing markets, the problem is even more acute. Up to 70% of developing market MSMEs report inadequate access to financing.

How can this vital swath of industry be better supported? Part of the answer may lie with TCI.

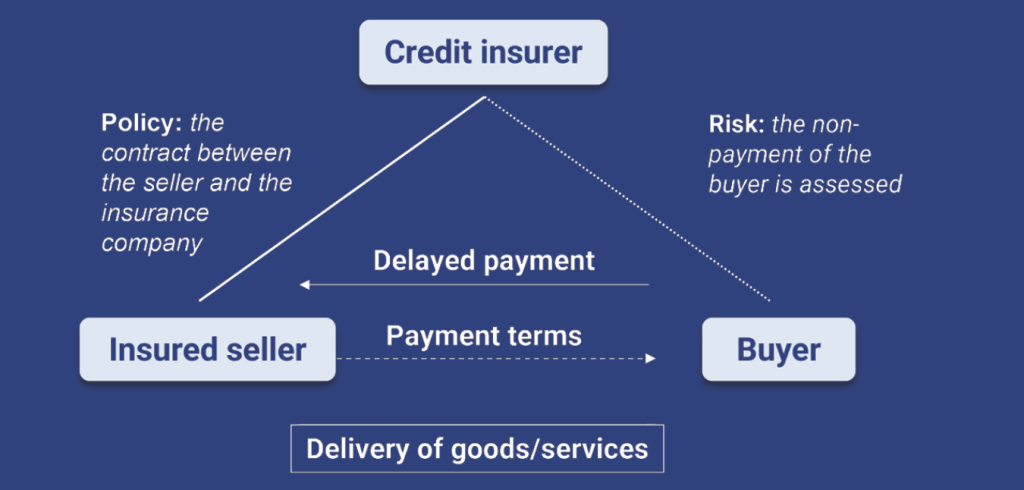

Trade credit insurance is a type of insurance that protects sellers against the non-payment of invoices. While several types exist, the most common form of TCI found in the market is on a whole turnover basis. This means that protection is provided to sellers against non-payment from any of their buyers.

According to ICISA estimates, the global market for TCI in 2023 was over 15 billion Euros in premium, which corresponds to an estimated 9 trillion Euros worth of insured shipments or 15% of world trade.

TCI can be used by companies of all sizes to protect both exports and domestic trade. It is most prevalent in Europe but is also growing in the US, Africa, and the Middle East as knowledge of the product improves.

For SMEs, these policies can significantly impact their access to financing, which is often their purpose in becoming policyholders. From a financier’s perspective, TCI substitutes the default risk of a company’s trading partners with that of a highly rated insurer, meaning that the financier will be more comfortable providing financing at greater volumes or on better terms.

Trade credit insurance, then, is far more than a mere safety net for exporters. It can also be a powerful enabler of growth for the small businesses that use it. Unfortunately, many still don’t.

Given the risks SMEs face—and the advantages that trade credit insurance (TCI) can offer—you might expect it to be widely adopted. In some advanced economies, it is. SMEs comprise the majority of TCI policyholders in many OECD markets, where distribution networks are strong, and awareness is relatively high.

But globally, the picture is far more uneven. Despite its benefits, TCI remains significantly underused by SMEs, especially in developing markets.

One of the central challenges is cost. For insurers, servicing SME policies can be disproportionately expensive. The premiums SMEs pay are small, but the fixed costs of onboarding, underwriting, and ongoing policy servicing are not. According to the ICISA report, even with historically moderate loss ratios, the cost-to-income ratio for insurers is skewed when dealing with small-value policies, particularly in the first year. Customer support, account management, credit limit monitoring, and claims handling all add up, making it difficult for insurers to profitably serve SMEs without the help of digital automation.

Then there’s the issue of data (or, rather, the lack thereof). Credit insurers depend on reliable, current information about buyers and sellers to underwrite risk effectively. However, in many markets, SMEs operate below the radar with thin or non-existent credit files, limited public financial disclosures, and minimal digital footprints. This problem is magnified in developing countries where company registries are less robust or not easily accessible.

And those are just the problems for SMEs that know about TCI to begin with. Many have never heard of it, let alone understand how it works or how to access it. Brokers, banks, and factoring companies do play a role in distribution but often prioritise larger, more profitable clients.

The good news? There are practical solutions, and ICISA lays them out in its report.

ICISA lays out six recommendations in its report for how to expand access to trade credit insurance and, by extension, help SMEs around the world improve their financial position. These recommendations are to:

Given the small size of TCI relative to some other insurance classes, many regulators and policymakers are not particularly familiar with it. Improving understanding among both of these groups can help with expanding the product to SMEs.

Digital tools for trade are projected to have wide benefits, especially for SMEs. The data they bring can paint clarity onto the once opaque financial image that many insurers and financiers had of some SMEs. ICISA notes, however, that the push towards digitalisation must balance innovation with consumer protection.

Governments should help to educate their SMEs on the different aspects of financial management and work to develop the skills and knowledge they need to access commercial financial services products. Education around TCI can and should be included in this.

Outcomes of court proceedings should be predictable and based on clear laws. TCI relies on the effective resolution of insolvency proceedings and disputes to ensure satisfactory payment of claims and collection of debt.

There are many methods through which a business can be identified, but governments need to ensure that they have a robust system and standardised system so that credit insurers and other financiers are better able to offer their products and services in a given market.

Banking and insurance regulations need to be designed in a way that allows risks to be managed efficiently. Including the TCI industry during the early stages of such planning can help ensure that insurers are ready for any changes that may come.

Tod Burwell

Jun 06, 2025

Carter Hoffman

Jun 06, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.