VIDEO | BAFT CEO: Charting the course for transaction banking in a fractured world

Tod Burwell

Jun 06, 2025

Carter Hoffman

Apr 10, 2025

Carter Hoffman

Apr 10, 2025

The US dollar (USD) has been the undisputed international currency of choice since the end of the Second World War. Over the last few years, however, there has been a lot of talk about the dollar being dethroned. Some say it’s coming soon. Others counter that such prophesizing ignores too many traits of the dollar that make it suitable for such a ubiquitous purpose.

What can’t be ignored is the data.

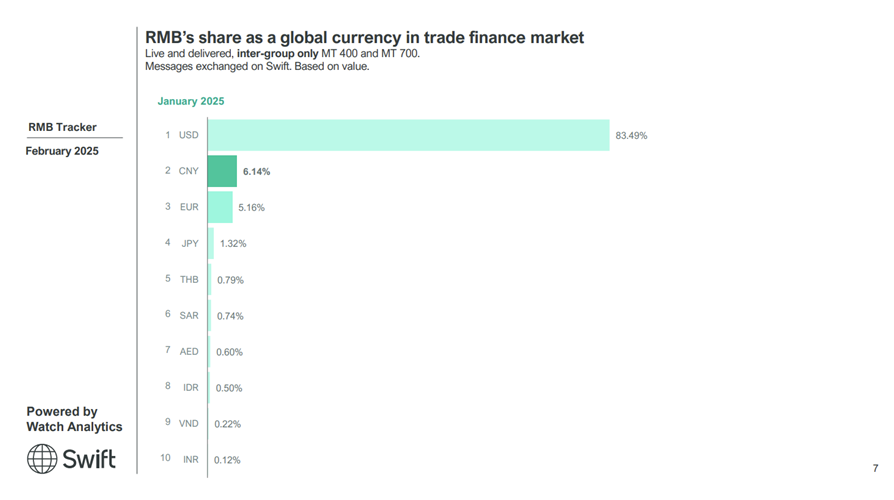

Over the last half-decade, the share of other currencies, like China’s Renminbi (RMB) or India’s Rupee (INR), in global trade transactions has increased by a noteworthy amount. Don’t get it wrong; the Dollar still reigns supreme (approximately 83.5% of the value of trade finance messages on the SWIFT network in January 2025 were denominated in USD). But its kingdom may be shrinking.

To get a better grasp on the battle for currency dominance, let’s have a look at use patterns of the USD, RMB, and INR in international trade and contemplate the potential implications for global trade.

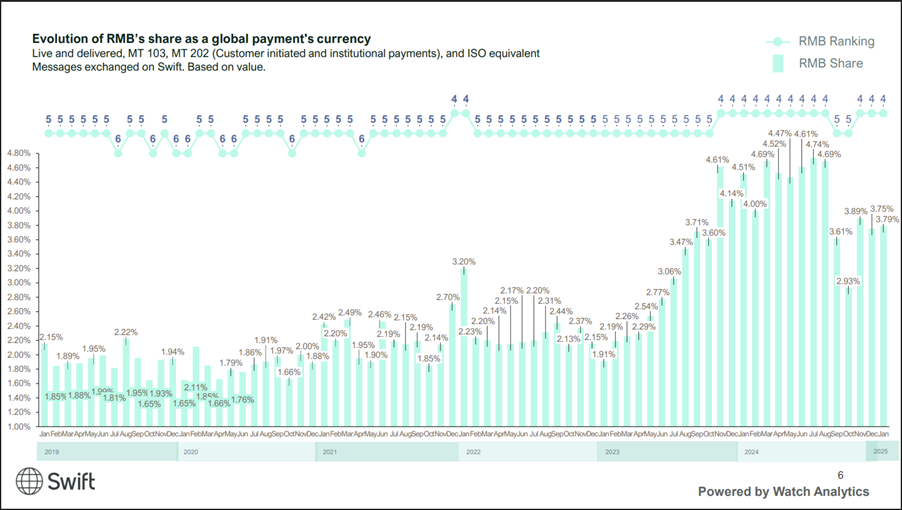

Five years ago, in January 2020, just many of us were hearing the first reports of a novel coronavirus spreading within China, the share of that nation’s currency in global payments (i.e. live and delivered MT 103 and MT 202 messages on the SWIFT network) sat at around 1.65%. By January 2022, that share had risen to 3.20%. In July 2024, it was 4.74%.

Looking specifically at the trade finance market (I.e., live and delivered inter-group only MT 400 and MT 700 messages on the SWIFT network), in January 2025, the RMB surpassed the Euro as the second most used currency by transaction value, reaching 6.14%.

While still a far cry from the USD’s 83.49%, this growing percentage is not one that can easily be put aside and owes some credence to efforts within China to promote its global usage.

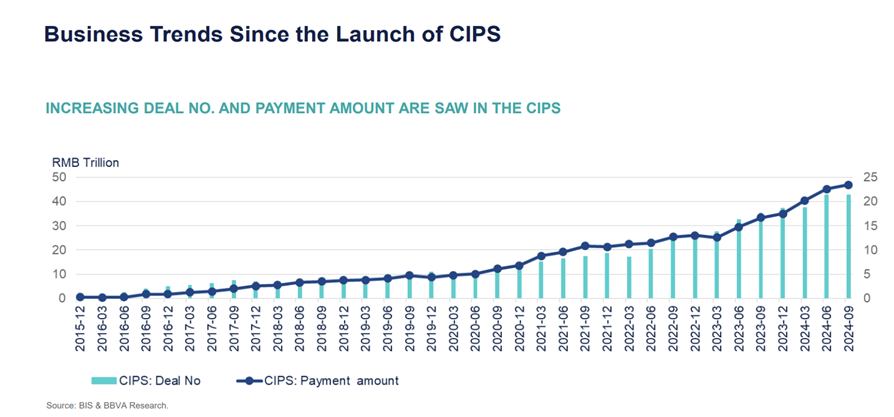

One such example is the People’s Bank of China’s Cross-Border Interbank Payment System (CIPS), a SWIFT-like payment system designed to process and settle cross-border transactions in RMB. From its launch in 2015 to the end of December 2024, CIPS has cumulatively processed approximately RMB 600 trillion in various payment transactions, with an average year-on-year increase of 43%.

China also actively promotes the RMB in other ways. For example, it promotes the international use of the RMB through the Belt and Road Initiative (BRI) by establishing bilateral currency swap agreements with participating countries, which provide direct RMB liquidity to partner central banks.

Over half (50.17%) of all global payments are made using the USD. Exclude payments made within the Eurozone, and that figure rises to 59.86%. There are many reasons for this outsized position, but several factors are also driving diversification away from the dollar.

While nearly an endless array of factors play a role, there are three main reasons behind the USD’s strength. The first is the deep liquidity of USD markets, which makes it relatively frictionless to conduct international trade transactions in the currency. Second is the USD’s role as the global reserve currency, which further strengthens its global acceptance. Third is its establishment within the financial infrastructure, which makes it easy for banks to run USD-denominated transactions because that’s the currency their systems predominately use.

Several factors are also driving diversification away from the USD. Geopolitical tensions and sanctions are the most prominent. Trading in USD puts a lot of power in the hands of the USA. When the USA imposes economic sanctions on a nation, that nation’s need to make payments internationally does not stop; it just needs to find a new way to pay for things. As the US has played this card, several nations have noticed and taken steps to make sure they have another currency basket to put their payment eggs in.

For better or for worse, the global currency landscape is changing with each day that these opposing forces push up against one another.

Though the Indian Rupee (INR) still only holds a relatively tiny share of global trade finance transactions (with only 0.19% as of January 2025), it has quietly edged its way into the top ten currencies used internationally.

One explanation for this is the world’s second most populated nation’s impressive economic improvements over the last decade, with its annual GDP growth consistently outpacing that of many developed economies. India is now a major trading partner to a range of countries across Asia, the Middle East, Africa, and even parts of Europe, which is inevitably generating demand for transactions denominated directly in INR. India has also been promoting INR-denominated trade through its trade agreements, including recent deals with Russia and several Middle Eastern and ASEAN countries.

With these concerted economic and regulatory efforts, it’s reasonable to anticipate that INR’s global prominence, though currently modest, will continue to increase steadily in the coming years.

This is the point of the article where I could use the points outlined above to make a sweeping claim about how the world is changing around us. I could join the chorus of dollar denouncers and argue that its time in the spotlight has come to an end and that the world needs to get ready for the next act with a new leading figure.

All of that seems a little much. The data indicates that the way that payments are made around the world is changing. Slowly, but changing nonetheless. This trend is one worth paying attention to.

Currency diversification brings practical benefits (like reduced transaction costs, improved financial flexibility, and lowered risk exposure to geopolitical events), and it opens doors for financial innovation as institutions and fintech companies race to support new cross-border payment methods and systems.

Yet, it’s essential to maintain perspective. while the USD’s dominance might diminish slightly, its foundational strengths will likely secure its key role for years to come.

For exactly how many years that is, we will just have to wait and see.

Tod Burwell

Jun 06, 2025

Carter Hoffman

Jun 06, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.