VIDEO | BAFT CEO: Charting the course for transaction banking in a fractured world

Tod Burwell

Jun 06, 2025

Carter Hoffman

Apr 16, 2025

Carter Hoffman

Apr 16, 2025

Trade improves lives. Many of the most important physical items in our lives (from our cell phones to our coffee) come from outside of our home country. International trade is how it got there.

Unfortunately, today, the established rhythms of international trade are being disrupted, shaken by policy decisions with the potential to reverse decades of progress.

It is against this uncertain backdrop that the World Trade Organization (WTO) has released its latest Global Trade Outlook 2025 report, with a glimpse into the trends that may be waiting on the horizon for global commerce.

In this article we are taking a look at the WTO’s report, to see what they have to say about why trade volumes are contracting, how the global economy is adjusting, and what these shifts mean for major economic powers and regions around the world.

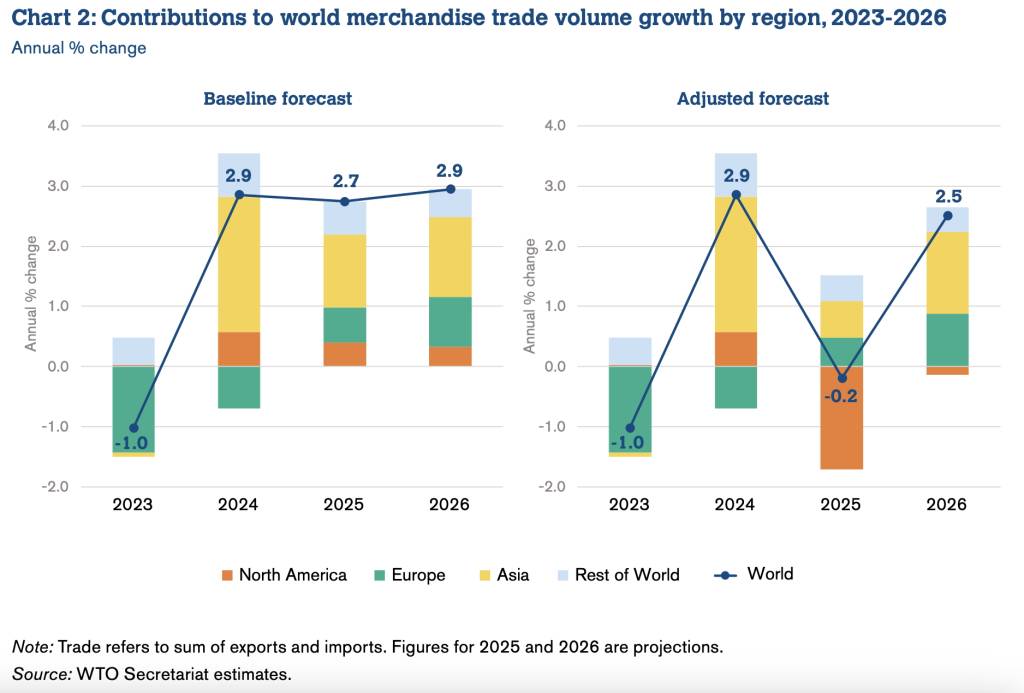

The WTO report predicts that global merchandise trade volumes will decline throughout 2025, albeit only by 0.2%. This small contraction, however, is markedly different from the previous baseline projections of a 2.7% increase over the same time frame.

In particular, North America, under the revised projections, is expected to subtract 1.7% from world trade growth in 2025.

The protectionist rhetoric and trade policy disruption coming out of the White House, including US President Trump’s “Liberation Day” announcement of at least 10% tariffs for nearly all trading partners, are central to the more pessimistic air of this latest report.

Industries such as technology, electronics, agriculture, and automotive, which form the bedrock of modern supply chains, now exist in a state of uncertain limbo, waiting to see which measure will come into force while they plan to mitigate the fallout.

As trade volume contracts, so too does the broader economic outlook. The WTO has revised down its global GDP growth projections. The new forecast is 2.2% growth for 2025, whereas in their previous baseline it was 2.8%. More concerning, however, is the prediction that a wider spread of trade policy uncertainty would further drop global GDP figures to 1.3% below that baseline.

Regions heavily reliant on exports, particularly developing nations, feel particularly exposed as their economic prospects are increasingly vulnerable to external decisions.

What was once a smoothly operating global trade system now faces blockages and inefficiencies, with immediate ripple effects stifling investment and curtailing business expansion plans.

Nowhere is the disruption more evident than in the relationship between the United States and China.

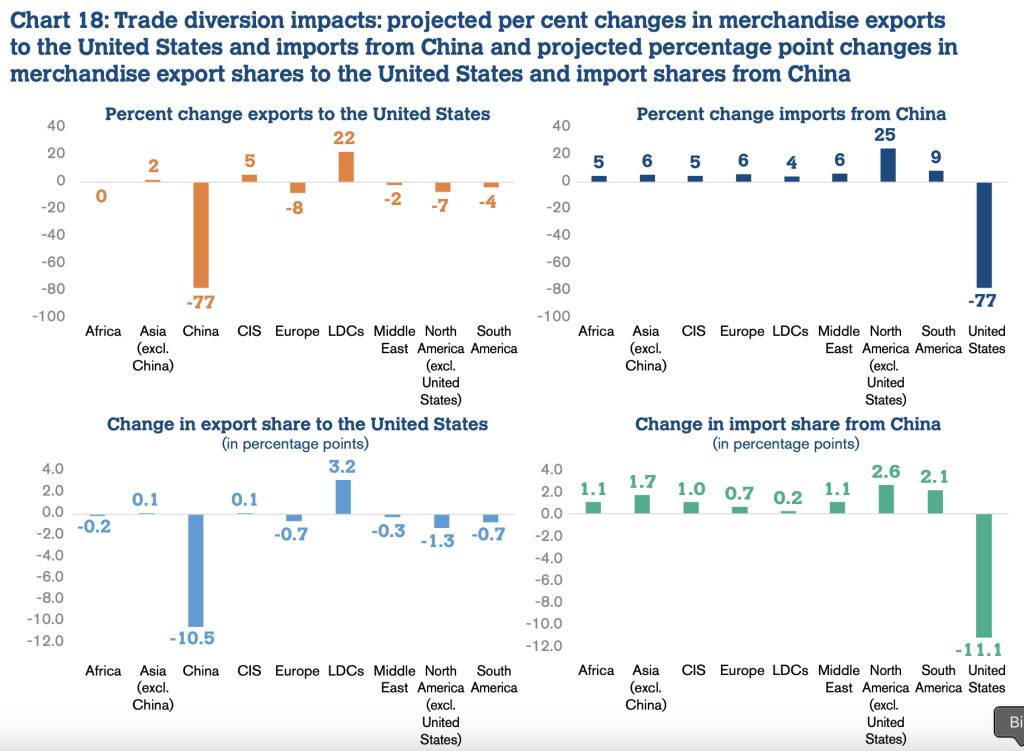

The WTO’s analysis aligns with the rhetoric coming out of Washington and Beijing, as the organisation predicts a 77% decrease in China’s exports to the USA. The WTO estimates this decoupling and further fragmentation into geopolitical trading blocs could lead to a long-term reduction of global GDP to the tune of 7% by 2040.

Notably, this decline in China’s exports to the USA seems to suggest a mere reshuffling of trade destinations for Chinese-made wares. The WTO projects imports from China to increase in every other region of the world, with the largest increase occurring in North America (excluding the USA), which is expected to see a 25% rise in imports from China.

The decline in US-Chine trade does have positive implications for some. With textiles, apparel, and electrical equipment flows from China to America being effectively cut off, there are opportunities for other nations to step up and meet the demand.

The WTO report notes that this could open the door for some Least Developed Countries (LDCs) to increase their exports to the US market.

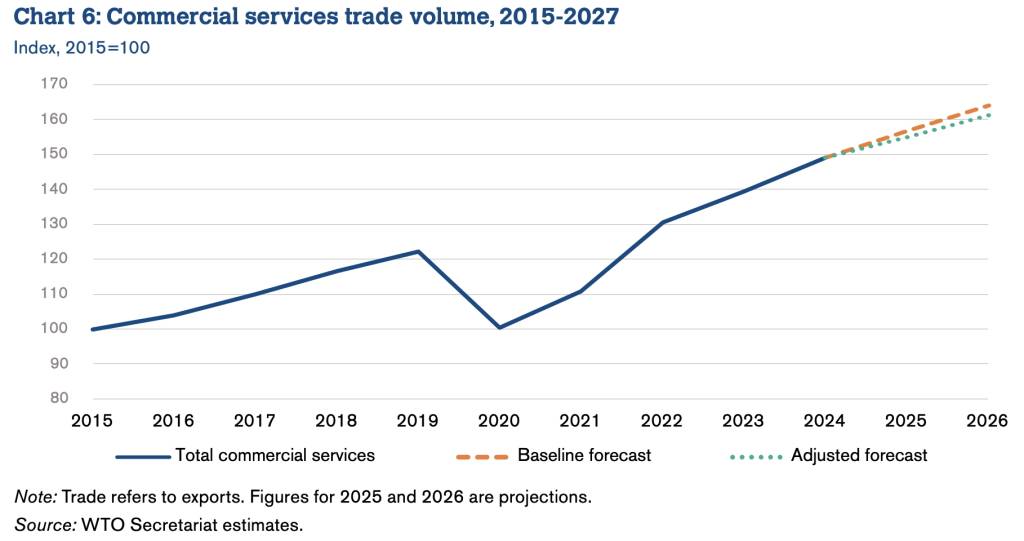

The silver lining of the trade policy disruptions since US President Trump took office for a second term comes in the resilience of services trade, which haven’t attracted the same tariff-related ire as their goods-based counterpart.

According to the WTO, global commercial services trade is now expected to expand by approximately 4.0% in 2025, and again by 4.1% in 2026. While this is a decline from the original baseline expansion projections of by 5.1% and 4.8% in 2025 and 2026, respectively, these projections have fared much better than those for trade in goods.

While services are not directly impacted by tariffs, they can still be affected by the ripple effects, particularly those intermediate services that support trade in manufactured goods.

For example, R&D services, IT services and various business services, are liable to be affected by the current economic context and may face a decline in demand. Financial services may also be affected, as the uncertain economic context can translate into lower investment and fewer transactions.

Developed economies, already heavily reliant on service-driven growth, find some solace in these projections, and services related trade may help to partially cushion some of the economic shocks that many analysts expect on the horizon.

—

The WTO’s latest report paints a grim layer atop a previously promising global trade and growth trajectory. Merchandise trade values are expected to decline in 2025 and global GDP growth will be slower than previously anticipated. US-China trade decoupling is upending longstanding trade relations and supply chain patterns.

Thankfully, the resilience of many aspects of the services sector that will avoid the strong impacts of Trump’s tariff wars will help to cushion the blow, particularly across the services-heavy developed world.

Tod Burwell

Jun 06, 2025

Carter Hoffman

Jun 06, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.