VIDEO | BAFT CEO: Charting the course for transaction banking in a fractured world

Tod Burwell

Jun 06, 2025

Carter Hoffman

Apr 11, 2025

Carter Hoffman

Apr 11, 2025

New research from MillTechFX, an FXaaS firm, shows a change in how corporates are managing their foreign exchange (FX) risk.

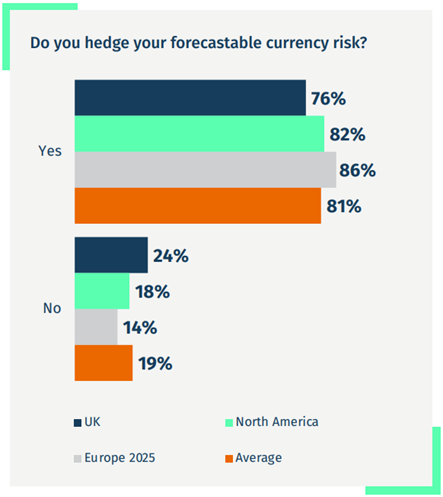

The MillTechFX Global FX Report 2025, based on a survey of 750 senior finance leaders across Europe, North America and the UK, shows that 81% of corporates are now hedging forecastable currency risk. Most firms are also extending their hedge lengths and maintaining consistent hedge ratios, even though the costs of hedging have risen.

Here are our key takeaways from the 55-page report.

Corporate hedging is now the norm across major regions. Adoption is highest in Europe (86%), followed by North America (82%) and the UK (76%). The uptake comes as no surprise, given that three-quarters of corporates experienced losses from unhedged FX exposure in the past year, with US-based firms reporting the highest incidence (77%).

Average hedge ratios remain relatively uniform across markets (49% in Europe and North America and 45% in the UK), while hedge tenors are also tightly grouped. UK corporates report the longest average hedge length at 5.5 months, slightly above the European (5.4 months) and North American (5.1 months) averages.

Notably, 68% of UK corporates that aren’t currently hedging are now considering doing so, although that figure is much smaller in North America (51%) and especially Europe (36%).

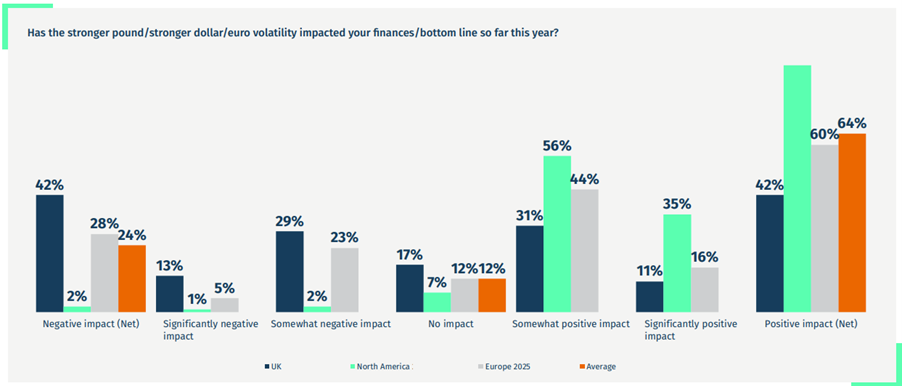

The start of 2025 has already seen major currency swings and materially impacted corporate performance for many. The US dollar strengthened following the Trump administration’s new round of tariffs. The pound has fallen to a one-year low after peaking in late 2024. The euro remains volatile.

According to the report, 88% of firms say movements in domestic currencies have affected their financial results. North American companies were most exposed (93%), with a stronger dollar benefiting import-heavy sectors but reducing export competitiveness. In the UK, 42% of respondents cited the stronger pound as a drag on performance.

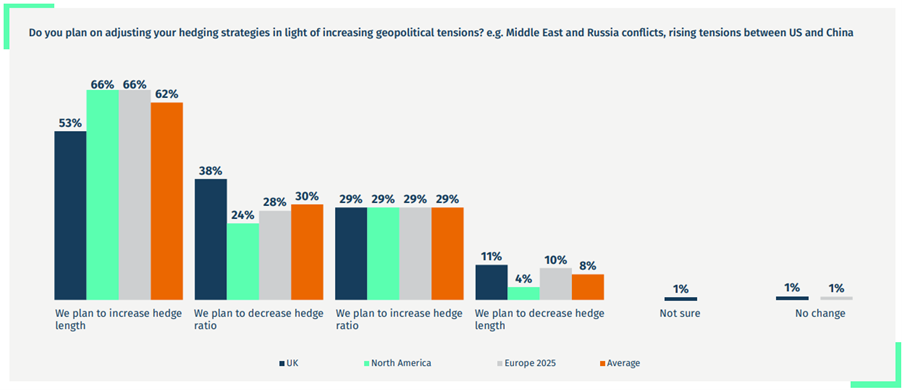

In response, 62% of corporates globally indicate that they are planning to increase hedge tenors, with only 8% saying they plan to shorten them. Meanwhile, 30% say they are reducing hedge ratios. North America and Europe led the move to longer hedges (both at 66%).

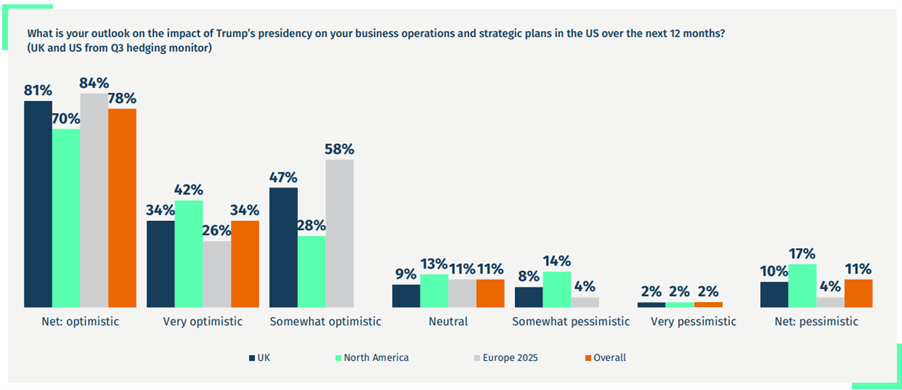

According to the survey data, more than three-quarters (78%) of firms were optimistic about the business implications of Trump’s presidency, with European corporates being the most upbeat (84%).

It is worth noting however that the survey was conducted before Trump’s comments that the EU was created to, “screw the United States,” and his plans for tariffs on goods made in the EU, which would likely impact European corporates’ optimism.

Optimism among UK firms followed closely with 81%. North American optimism was lower at 70%, possibly reflecting concern about Trump’s preference for a weaker dollar.

Further, the entire report was published prior to Trump’s “Liberation Day” announcements of reciptocial tariffs on nearly all trading partners.

Around a third of corporates still rely on manual instruction methods (i.e., phone (34%) and email (32%))to execute trades. These legacy processes contribute to fragmentation, cost opacity, and inconsistent execution quality.

In response to these challenges, corporates are turning to automation and artificial intelligence (AI) to modernise FX workflows. All surveyed firms are now exploring AI use cases. The most common applications include risk management (45%), FX operations (41%), and process automation (40%).

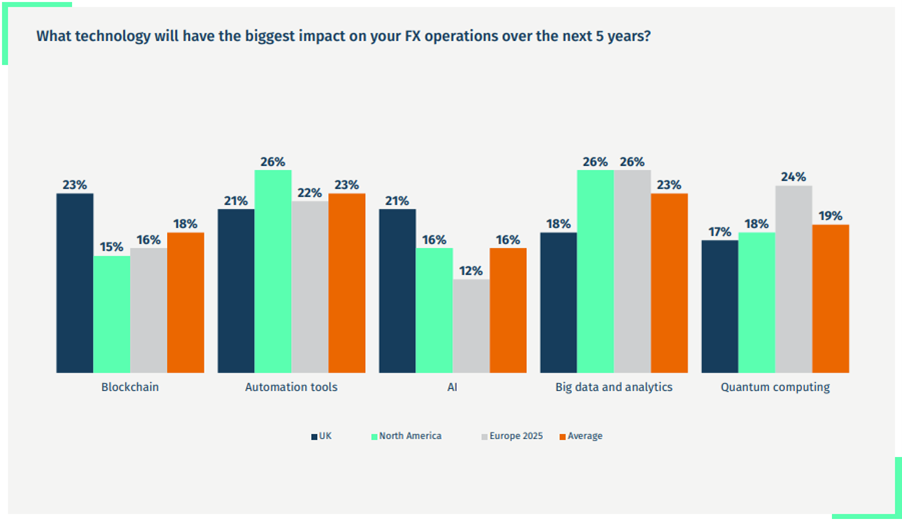

In terms of the technology that will have the biggest impact on FX operations over the next five years, respondents were most excited by automation tools and big data analytics (each with 23% overall). AI had the smallest share of respondents indicate that it would have the biggest impact over the next five years.

The findings of the MillTechFX Global FX Report 2025 reflect a maturing view of FX exposure.

Corporates are increasingly treating currency risk as a strategic imperative. Hedge ratios and tenors are converging across markets, operational pain points are being mapped and addressed, and new technologies are being deployed to improve execution quality and transparency.

What’s equally clear is that the opportunity cost of inaction is rising.

While hedging costs have increased, the data shows that unhedged risk has carried a higher price. With markets in flux, the case for proactive risk management, backed by modern infrastructure, is stronger than ever.

Tod Burwell

Jun 06, 2025

Carter Hoffman

Jun 06, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.