Periodic Table – Blockchain and DLT for Trade

Contents

The Periodic Table of DLT Projects provides a means of beginning to conceptualize and differentiate between the countless initiatives, projects, consortia, and companies operating in the broad space that can be described by the phrase: DLT in trade. While no simplified diagram of the landscape can ever be able to fully encapsulate the minutiae and nuances of each and every project, this table provides a starting point for understanding and analyzing the industry.

Methodology

To categorise the initiatives, we began by generating four broad groupings: trade finance, network of networks, insurance, and supply chain digitisation. To further nuance each group, a subsequent eight categories were developed. These categories, represented by the different colourings in the table, are: trade finance initiatives, supply chain DLT initiatives, Shipping and Freight, DLT digitisation of trade documents, non-DLT networks in trade finance, other initiatives in trade and supply chain finance, network of networks, and insurance. Assigning each initiative to a group and a category, and then loosely arranging them based on their current state of development, has left us with an improvised snapshot of the ecosystem.

The periodic table was selected to represent this for several symbolic reasons. Firstly, the Periodic table’s natural inclination is to simultaneously represent striking similarities and distinct differences. On the actual periodic table, hydrogen may be most similar to helium in terms of mass, but the two remain radically different when comes to features like reactivity. On the trade finance periodic table, similar comparisons and contradictions can be made between the projects. Simply because two projects are positioned close to one another, does not mean that these projects can be considered similar across every dimension.

Another reason for selecting this design is its pre-supposed intention to grow and morph over time. The first periodic table of elements, developed in the 1860’s, was made with intentional blank spaces, intended to one day be filled with elements that were predicted to exist, but not yet known. This design represents an inherent understanding that the landscape existing at any given time is not expected to last forever, but will see changes emerge over time. That is how the periodic table of DLT products has been envisioned as well: merely as a momentary snapshot of the industry as it exists today, with plenty of space to grow and change as the forces of Adam Smith’s invisible hand continue to play.

Stages of maturity

The circles shown in the bottom right elements indicate what we believe is the current stage of maturity of the various DLT projects that we cover in this white paper. If 1 represents the conceptual / proof of concept (POC) stage and 5 represents live and running (across all products and to all customers), the average stage of the projects under consideration is around 2.4, indicating that most projects are between the pilot and early stages of production.

In the subsequent sections we will delve deeper into each of the projects and initiatives that we have identified in the periodic table, providing an inkling of an insight into the purpose of these projects, their composition, and the progress they have made to date.

Infographics, Charts & Diagrams

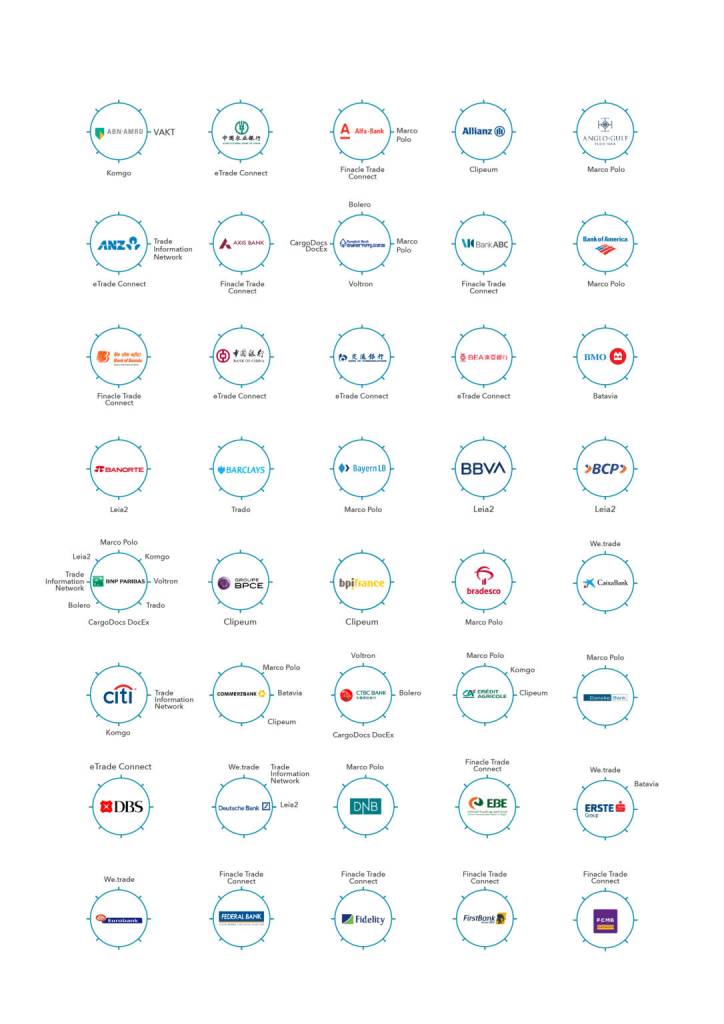

Projects by Banks

Key Graphs

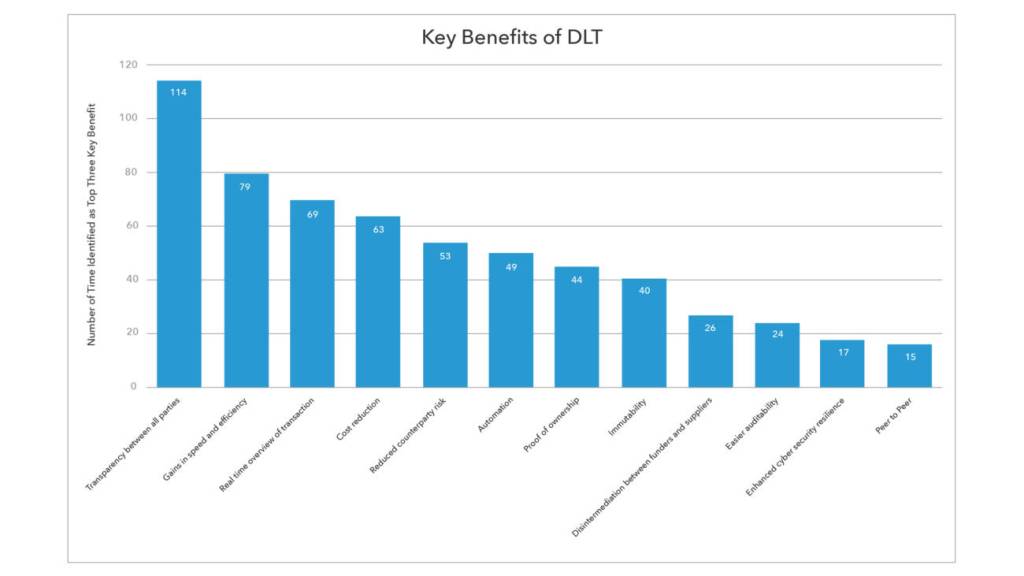

Key benefits of Distributed Ledger Technology (Source: TTP, ICC and WTO Blockchain for Trade Survey, October 2019. Responses from corporates, banks, consultancies and vendors, n = 202)

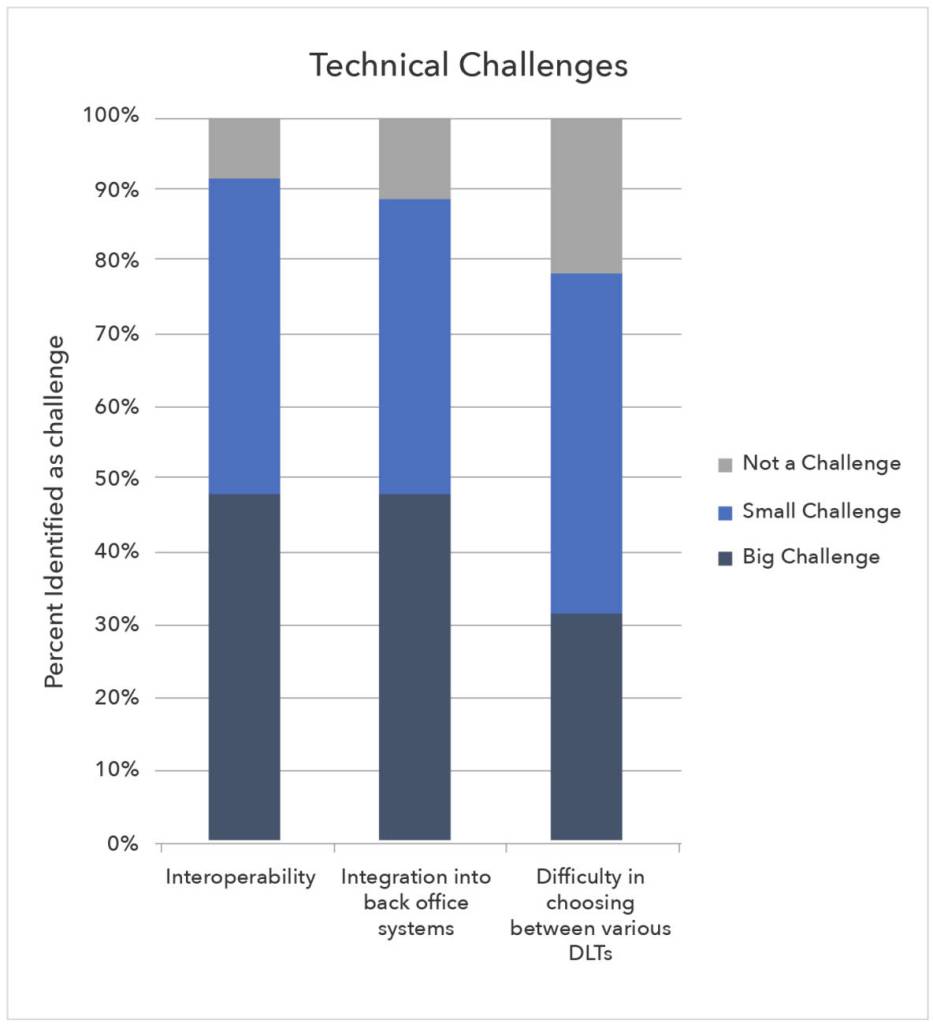

Technological challenges around Distributed Ledger Technology (Source: TTP, ICC and WTO Blockchain for Trade Survey, October 2019. Responses from corporates, banks, consultancies and vendors, n = 202)

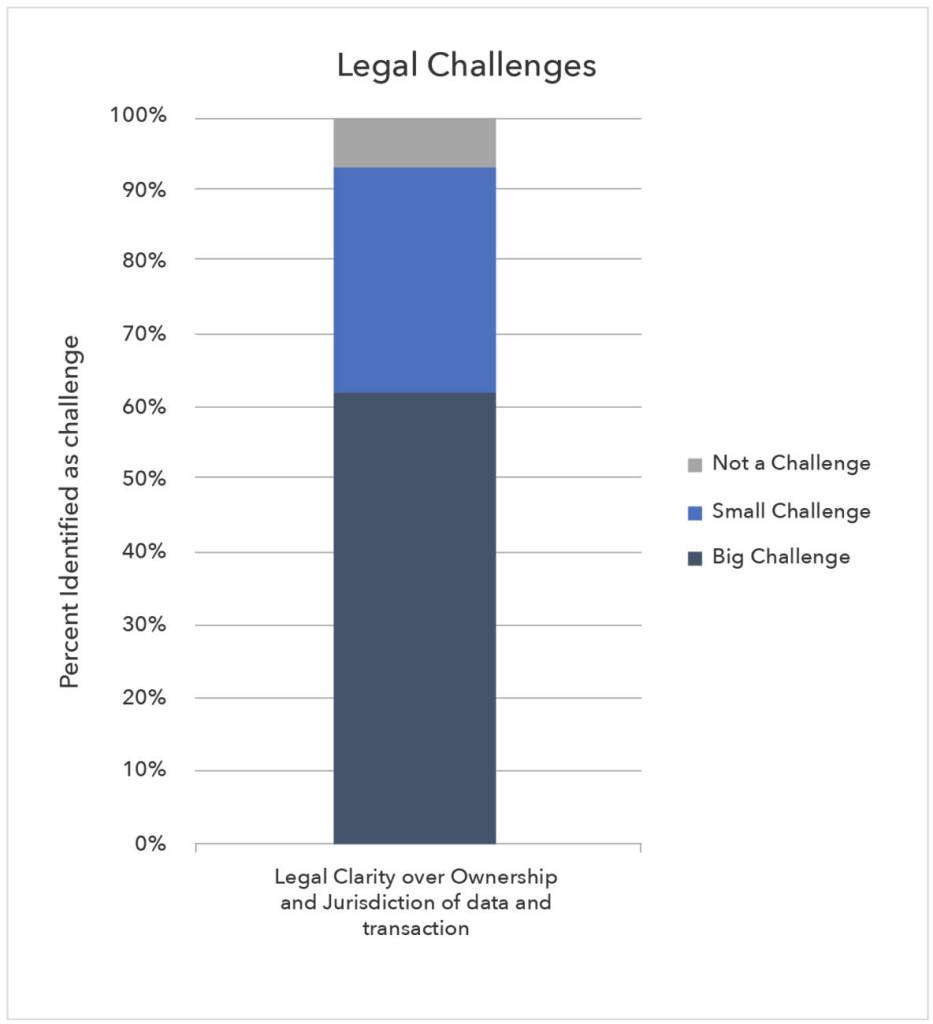

Technological challenges around Distributed Ledger Technology (Source: TTP, ICC and WTO Blockchain for Trade Survey, October 2019. Responses from corporates, banks, consultancies and vendors, n = 202)

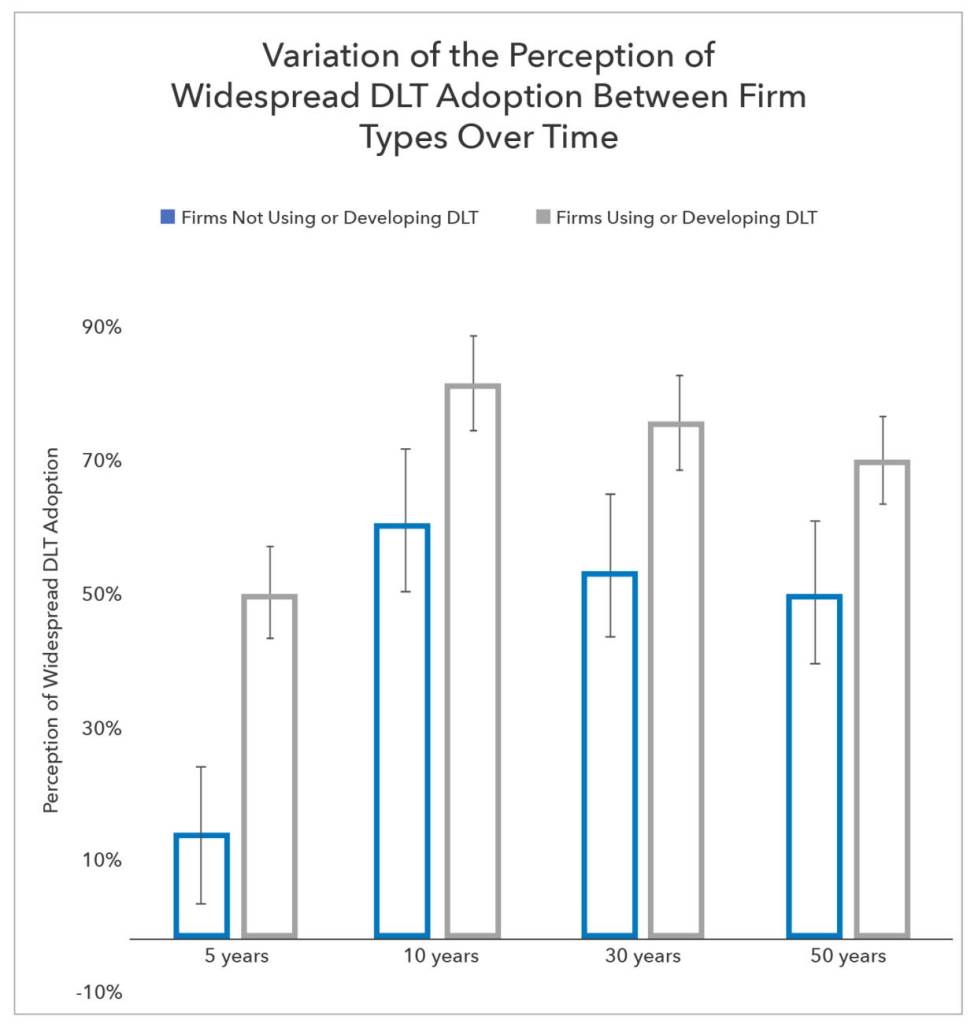

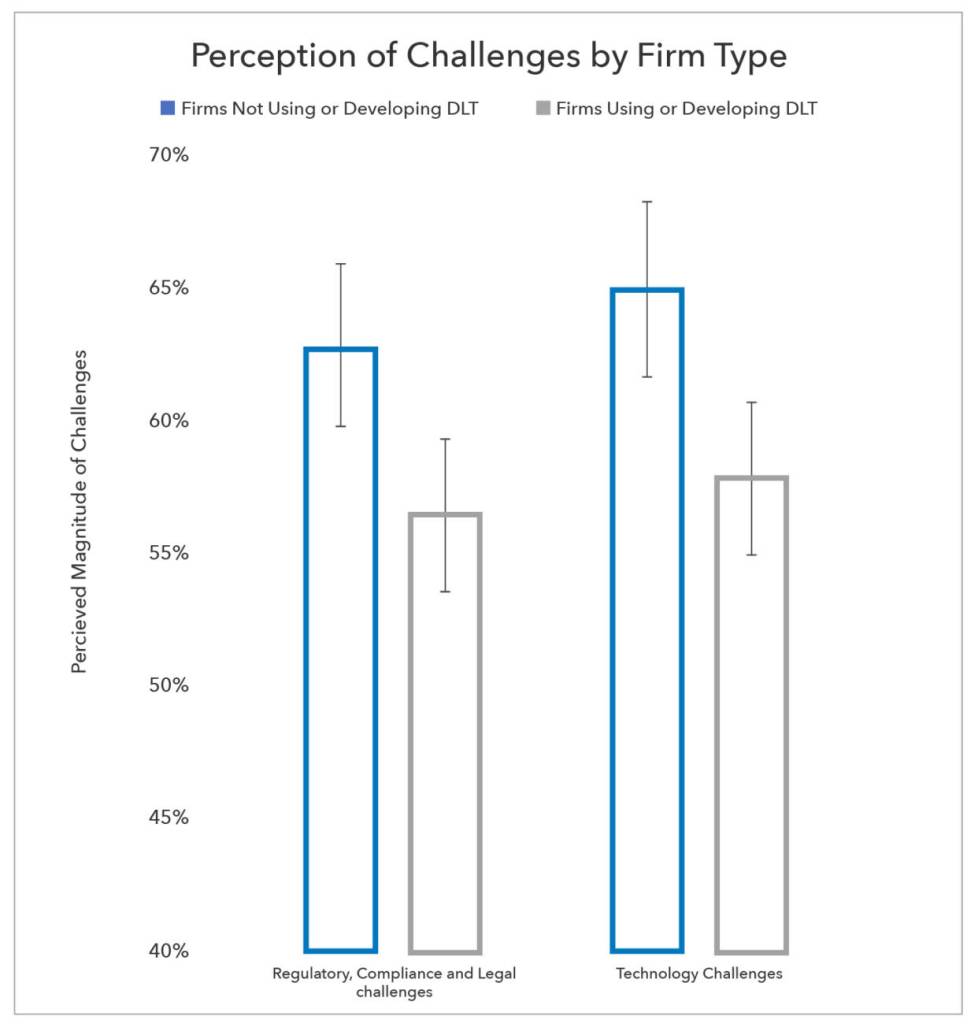

Perceptions of widespread DLT adoption between different types of firms, as well as the key challenges by firm type (Source: ICC, TTP and WTO Blockchain for Trade Survey, October 2019. Responses from corporates, banks, consultancies and vendors, n = 202, lines indicate standard deviation)

Perceptions of widespread DLT adoption between different types of firms, as well as the key challenges by firm type (Source: ICC, TTP and WTO Blockchain for Trade Survey, October 2019. Responses from corporates, banks, consultancies and vendors, n = 202, lines indicate standard deviation)

Strategic Partners

- Blockchain & DLT Resources

- Cryptocurrency Resources

- All Topics

- Podcasts

- Videos

- Resources

- Conferences

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.

English

English