VIDEO | Digitalisation, tariffs and trade finance – what’s going on?

Sean Edwards

Jul 02, 2025

Deepesh Patel

Deepesh Patel

Carter Hoffman

Jul 02, 2025

Carter Hoffman

Jul 02, 2025

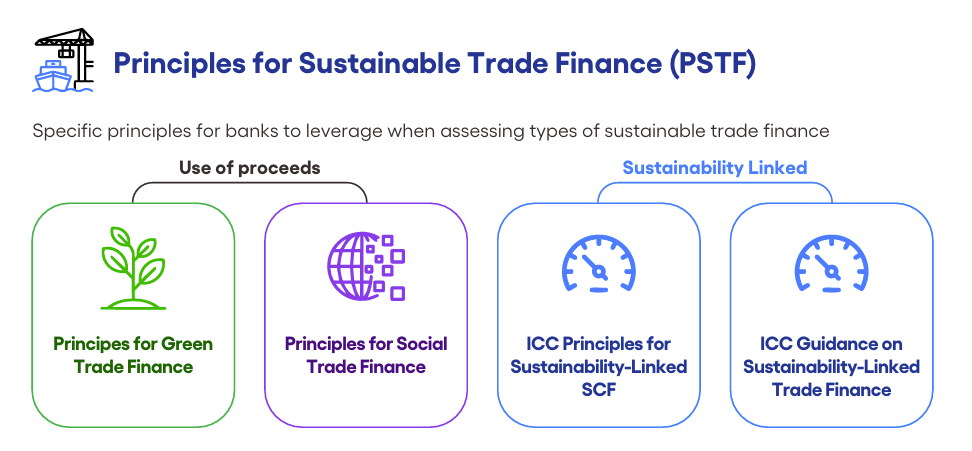

Seville. At the UN Financing for Development Forum (FFD4), the International Chamber of Commerce (ICC), in partnership with the Boston Consulting Group (BCG), has officially launched Wave 2 of its Principles for Sustainable Trade Finance.

Trade Treasury Payments (TTP) is an official media partner of FFD4, held in Seville, Spain, where these principles were unveiled.

The expanded framework is a significant step forward in the ICC’s ongoing effort to develop an industry-wide foundation for classifying, measuring, and ultimately scaling sustainable trade finance globally.

The Wave 2 release follows the successful debut of Wave 1 in 2023, which focused on Green Trade Finance. This second instalment widens the scope to include Social Trade Finance and Sustainability-Linked Supply Chain Finance (SCF).

With input from 50+ partner banks and stakeholders across 60+ countries, the initiative reflects both increasing market interest and the growing urgency to integrate sustainability considerations into trade and supply chain finance frameworks.

While the report is rich in ambition and thoughtful alignment with existing ESG standards, it also highlights several persistent challenges. In this article, we explore both the promise and the pressure points of the ICC’s latest push.

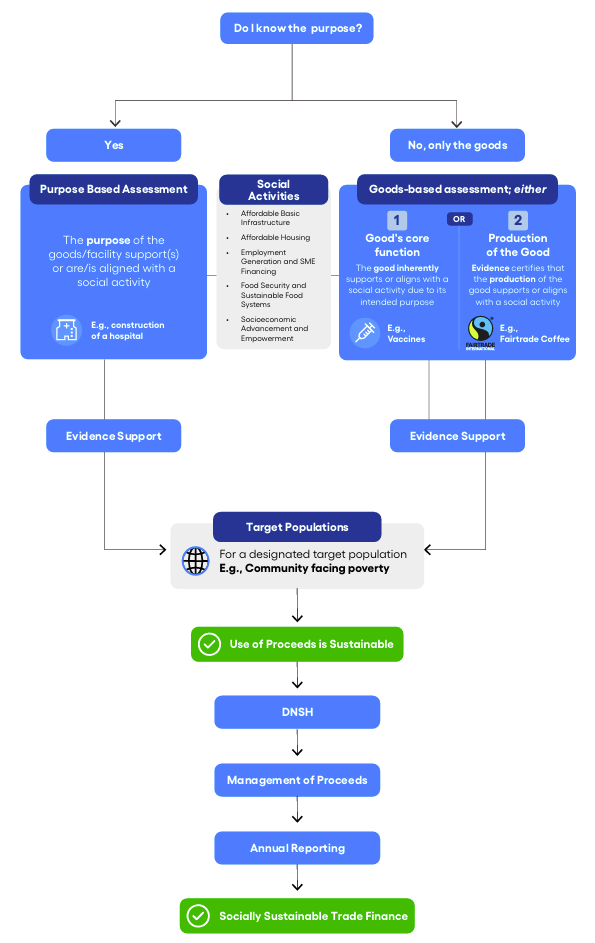

Wave 2 adds several dimensions to the ICC’s sustainable finance taxonomy. Most notably, it expands beyond Green Trade Finance to now include social trade finance (i.e., financing linked to social benefits, such as improved health, education, or access to essential services) and sustainability-linked supply chain finance (i.e., transactions that tie financing terms to measurable ESG performance improvements).

The report also introduces use-of-proceeds guidance for social transactions, aligns with frameworks such as ICMA’s Social Bond Principles and the EU Social Taxonomy, establishes 15 sustainability categories and provides decision trees and eligibility matrices to support classification, and recommends governance structures for financial institutions adopting these principles.

An updated tally shows that 51 institutions have now signed on to the Principles (up from 18 in Wave 1).

Andrea Frosinini, co-founder of the Open Working Group and TTP Global Advisory Panel Member, said, “Wave 2 of the ICC’s sustainable trade finance framework makes big changes that will help make ESG a bigger part of trade finance. These principles are going to change the market by making things clearer, more trustworthy, and easier to compare. The framework protects against greenwashing and social washing, works with current ESG structures, and lets you analyse the effect of trade products across the board.”

While the additions are timely and thoughtful, they raise practical and strategic considerations that merit unpacking. Below, we take a closer look.

The report’s ambition to define and standardise sustainable trade finance deserves commendation. By attempting to classify transactions by ESG outcome and provide practical guidance for implementation, the ICC is addressing a key gap. This is especially the case given that the short-tenor, self-liquidating nature of trade finance products has made them difficult to align with sustainability taxonomies that are designed for longer-term instruments.

Yet ambition alone does not translate to execution. Notably absent from Wave 2 is a set of fully worked examples or case studies showing how these principles operate in practice. While definitions and eligibility criteria are helpful, banks and corporates will likely still struggle with real-world application. The report calls for consistency, but leaves room for considerable interpretation.

A strong feature of Wave 2 is its explicit effort to align with existing standards. It references ICMA’s Social Bond Principles, the Loan Market Association’s Green Loan Principles, the EU Taxonomy, and the ISSB’s disclosure standards. This alignment is welcome, especially given that ESG taxonomies remain highly fragmented by region.

Andrew Wilson, Deputy Decretary General – Policy, at the International Chamber of Commerce, and Permanent Observer to the UN, told TTP, “Full convergence on ESG in trade finance won’t happen overnight — but the building blocks are now in place. With ICC’s expanded principles aligning to existing standards and open for consultation, we have a realistic path toward greater consistency. The key will be adoption, interoperability, and continued feedback from the market.”

However, aligning with multiple evolving standards risks creating a compliance tangle. The report itself concedes that interoperability remains a work-in-progress. As such, financial institutions face the dual challenge of updating internal systems to reflect these guidelines while at the same time having to contend with an ESG landscape that seems to constantly be in flux.

If not carefully managed, a well-intentioned alignment effort could devolve into a bureaucratic burden.

The increase in signatories from 18 to 51 is impressive but begs the question about what uptake really means.

The report rightly promotes adoption, but says little about actual implementation. There is no data on how many sustainable trade transactions have been booked under Wave 1 principles. Nor is there clear evidence of how Wave 2 will be operationalised in bank systems or client processes.

This gap between signing and executing is significant. Without real uptake, the Principles will struggle to achieve their desired impact.

There is also the challenge of making a framework such as this a reality across all markets, rather than just a select few.

Derryn Faure, Head of Trade Finance structuring, syndication & documentation at Investec and member of the TTP Global Advisory Panel, said, “From an African and developing market perspective, this still doesn’t address the practicalities of trade finance in emerging markets. It is very much still focused on trade finance in developed markets, is still very environmentally focused, SCF focused, and really doesn’t take into consideration the rest of the UN SDGs and the fact that most trade finance in emerging markets is part of transactional banking as opposed to being an investment banking product.”

Perhaps the most complex challenge in Wave 2 is how to safeguard the integrity of sustainable trade finance.

The report includes language around verification, reporting, and declassification of transactions that no longer meet sustainability thresholds. It even encourages third-party validation. These are all positive steps.

However, much of the language remains non-binding. Terms like “should” and “may” are well defined and heavily used throughout the report, but create room for interpretation that could erode credibility. While this may be good for soliciting agreement, without stronger assurance mechanisms or a common register of verified transactions, the risk of greenwashing remains. It is easy for a stakeholder to agree that it should do something, but a whole other commitment to actually do it.

In particular, the inclusion of social finance opens up new sensitivities. Measuring social impact is inherently more subjective than measuring carbon footprint. Ensuring that such transactions are not used to sidestep environmental standards will require vigilance.

Bob Gravestijn, Strategic Advisor for The Value Chain, told TTP, “ESG can’t be an add-on anymore. The ICC Principles prove this, they have baked sustainability into every core component of trade deals. Trade finance becomes a game-changer when you can tie funding to these assessments.”

Wave 2 of the ICC Principles for Sustainable Trade Finance is a meaningful evolution. Its expanded scope, alignment efforts, and broadened participation are a welcome sign of the industry’s growing maturity nd a step in the right direction.

Yet the report is also a reminder that consensus is not the same as clarity, and certainly not the same as impact. Execution remains elusive, interoperability still lags, and market-wide assurance structures are nascent.

As media partners of FFD4, TTP will continue to follow the rollout of the Wave 2 Principles closely across both developed and emerging markets.

We encourage all readers to download the full ICC Wave 2 Principles report.

Carter Hoffman

Jul 02, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.