Technology as a bridge and its limitations

Carter Hoffman

Jun 17, 2025

Carter Hoffman

Jun 17, 2025

Carter Hoffman

Jun 17, 2025

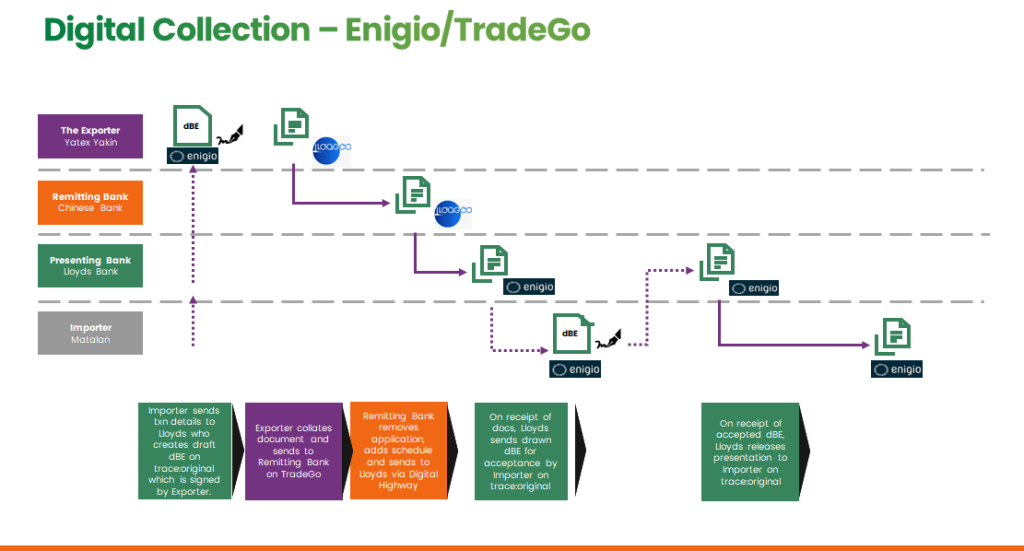

In a major milestone for cross-border trade digitalisation, UK retailer Matalan and Chinese exporter Yatex have completed a fully digital import transaction, working with Lloyds Bank and a major Chinese bank.

The deal was executed via an interoperable “digital trade highway” connecting European and Chinese trade platforms Enigio and TradeGo, enabling end-to-end electronic document exchange with no physical paperwork.

Significantly, all documents were exchanged and accepted between the UK and China in under 24 hours, whereas traditionally such processes can take over a month. This is the first live transaction using the Enigio-TradeGo connection for goods exported from China into Europe.

The digital trade highway refers to the interoperable digital channel that Enigio and TradeGo launched in October 2024 to connect their platforms, based on the Digital Container Shipping Association’s (DCSA) standards for electronic bills of lading (eBL). In practice, this means a corporate or bank using Enigio’s trace:original in Europe can instantly and securely transact with a counterparty using TradeGo in China, without either side leaving their native platform.

Notably, prior to the Matalan-Yatex deal, the Enigio-TradeGo link had been demonstrated on exports from Europe to China. For example, in late 2024, a Swedish pulp exporter (Global Forest Products) sent an electronic bill of lading and other documents via Enigio to a Chinese importer through TradeGo under a digital Letter of Credit.

In that case, Lloyds Bank (UK) served as advising bank under an LC issued by a Chinese bank subject to eUCP rules, and all documents (the eBL and supporting certificates) were transferred electronically to the importer in China, with the eBL ultimately surrendered digitally at the destination port.

That pilot proved the concept of a Europe-to-China digital trade corridor. The Matalan-Yatex transaction is the first China-to-Europe import using this infrastructure, confirming that the digital highway works in both directions for real, live commercial trades.

Traditionally, a transaction like this (a UK import from China under documentary collection or similar terms) would be heavily paper-based. Yatex would issue a paper bill of exchange and other trade documents (commercial invoice, packing list, bill of lading, etc.), and physically courier them from China to the UK.

The documents would pass through the hands of the exporter’s bank and the importer’s bank, and the importer would have to sign acceptance on paper and possibly mail documents back. It’s common for goods to reach the destination port while the paperwork is still in transit, causing costly delays until the original documents arrive.

End-to-end, such paper workflows often take 35-45 days to complete, factoring in shipping, handling, and verification of documents. There are also risks of documents getting lost or tampered with during transit, as well as significant administrative overhead in checking and reconciling paper forms.

In the fully digital scenario, these inefficiencies were eliminated. The process was initiated by Matalan, which instructed its bank (Lloyds) to facilitate the trade digitally. Lloyds Bank drafted an undrawn digital bill of exchange (BoE) on Enigio’s trace:original platform as per pre-agreed terms provided by the Chinese bank.

Once prepared, the digital BoE and all supporting documents were instantly shared via the Enigio-TradeGo channel with the Chinese bank and Yatex. Through the TradeGo interface, Yatex (the exporter) received the electronic documents and applied its electronic signature to the bill of exchange, formally issuing the digital BoE, and at the same time submitted its collection instructions (i.e. terms for release of documents to the importer) digitally.

Next, acceptance and confirmation were exchanged digitally between the banks. Matalan, upon reviewing the documents, could accept the bill of exchange obligation electronically (rather than signing a paper draft). This acceptance was communicated via Lloyds and the Chinese bank through digital means, including the SWIFT network for payment messaging.

Throughout this exchange, Enigio’s trace:original verification tools allowed each party to instantly verify the authenticity and integrity of the digital documents, so all sides were assured that the content was tamper-free and original. Once the importer’s acceptance was confirmed, the documents were immediately available to Matalan, enabling them to obtain release of the goods without waiting days or weeks.

No paper or couriers were needed at any point as everything occurred through secure digital channels. As a result, the entire transaction was completed in under 24 hours.

What makes this transaction stand out is that it was not a controlled pilot or trial, but a live commercial deal with real goods and payments at stake. It proves that fully digital trade workflows can handle real-world requirements.

“This isn’t a pilot. It’s not just talk. It’s a live transaction executed under real commercial conditions, with real goods moving and real payments expected,” said Alex Waites, Executive Director at Enigio. “It shows that with the right technology and collaboration, digital trade can be not only faster and safer but business-critical. We are moving to fully digital trade flows for real.”

His point is echoed by the customer. Susan Ashworth, Senior Trade Finance Specialist at Matalan, said, “This transaction demonstrates that digital trade is quick and efficient, especially when done in close collaboration. It streamlines processes, cuts transaction times, reduces carbon emissions and lowers costs for all of the parties involved.”

With global supply chains under pressure to reduce uncertainty, this live transaction is a powerful example that end-to-end digital trade is both possible and advantageous.

Jon Boran, Head of Future Trade Products at Lloyds, said, “The ability to seamlessly transfer electronic trade documents between solutions marks a new era in trade finance, and we are proud to be at the forefront of this innovation to bring real value to our client.”

As more corridors like this Europe-China digital highway open up, and as legal frameworks like MLETR gain traction, we can expect wider adoption of paperless trade, making international commerce faster, more resilient, and more sustainable for all involved.

Carter Hoffman

Jun 17, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.