Trade platforms vs. ERP integration: Finding the right strategy

Carter Hoffman

Jun 19, 2025

T.S. Shankar

May 02, 2025

T.S. Shankar

May 02, 2025

My first exposure to a major currency was when the EURO came into being in 1999. Still new to the FI world, we sold EUR nostro accounts to banks in the India Subcontinent in those days. Folks were reluctant to see the advantage, but slowly saw the light, and the French Franc and the Deutsche Mark slowly faded into oblivion.

My exposure to RMB began around 2012 or so. I remember a presentation we made to the financial institutions in Bangladesh, firstly by explaining that the RMB or Yuan was the same as CNY or Renminbi. That was confusing enough for me when we got started and then CNH came to be.

The bank that I worked for was a foreign member of CIPS and tasked with internationalising the RMB. We spoke about invoicing imports and exports to China in RMB. The bank officials were very nice and listened to the pitch. Then Q and A started, and one gentleman very politely asked, “But sir, we never invoice in RMB or Yuan, so why bother?” That was a decade or so ago. Today, 22% of Bangladesh Trade is with China, a substantial part, I believe, in RMB, which is now a currency the central bank allows accounts to be opened in.

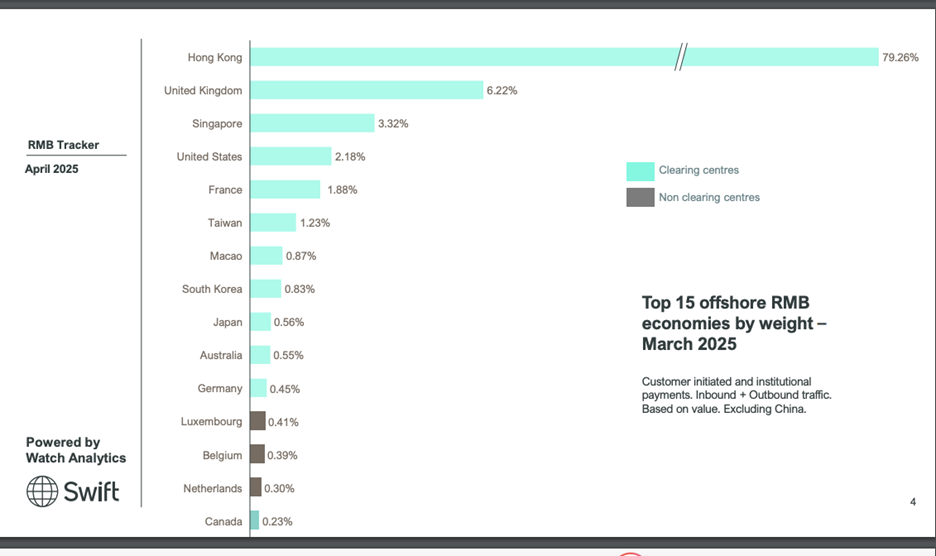

The RMB trade has grown substantially since then, with trading in over 12 offshore centres like Singapore and London. Admittedly, a large part of this is in HK – close to 80%, with the UK and Singapore making up about another 10%. But it is also cleared in the US with over 2%!

Over the years, China has been very creative in ensuring RMB use, including figuring out that regulations in Hong Kong could help – thus the CNH (H – for Hong Kong) as opposed to CNY. That was a masterstroke in my mind as it got importers and exporters comfortable with the currency without the extra regulatory framework.

We have been hearing anecdotal mentions of Russia and Iran dealing in RMB since they cannot connect to SWIFT (none in Iran, some in Russia). The clearing system in China, the Cross-border International Payment System (CIPS), with 36 domestic and overseas financial institutions as shareholders, has seen growth in volumes, as is evident from the chart below.

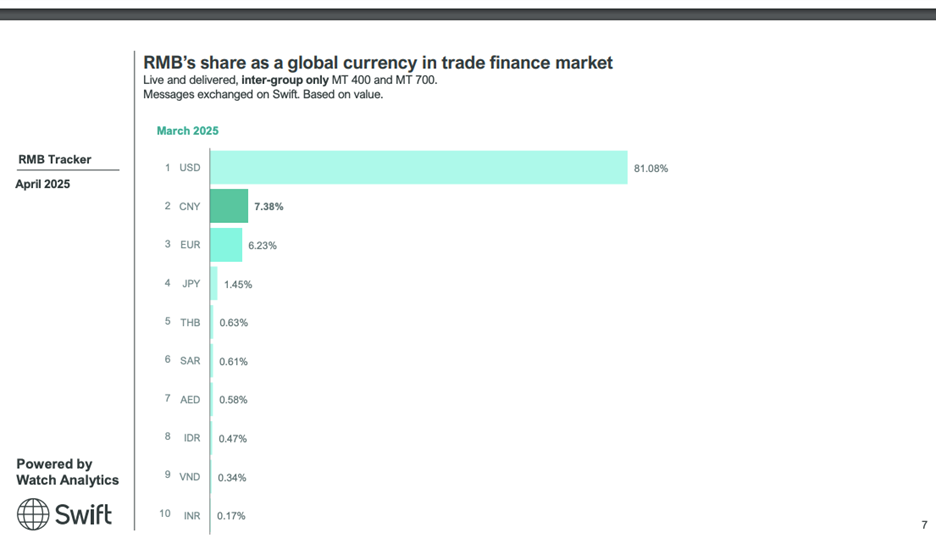

Linked to this is what SWIFT data from their RMB tracker shows us. RMB is the second largest currency for trade, superseding the EUR in January 2025 and now ahead by over 15% at over 7.38%.

This is a substantial jump in one month, but the trend is interesting. One theory behind this is that RMB invoicing is increasing. Another theory is that USD volumes have decreased while RMB is steady, which seems feasible given today’s geopolitics and tariff climate.

There is another voice that says this is just SWIFT data, and a lot of RMB trade is not on SWIFT. According to Chinese customs data, Russia’s bilateral trade with China has reached $240 billion. Chinese exports to Russia in 2023 exceeded $111 billion, 67% more than in 2021. Chinese goods now account for 38% of Russia’s imports, while 31% of Russia’s exports go to China.

Thus, the RMB is now the second largest Trade currency as per SWIFT for the third month in a row, having overtaken the EUR. The US dollar is still at 80% plus as per the above SWIFT data. But then again, not all RMB trade goes through SWIFT.

Will RMB trade volumes touch 10% by the end of the year? It’s hard to say, but seeing this rise, I will refrain from betting against it. After all, if in 10 years Bangladesh now trades more with China than India, and with the Belt and Road Initiative still a very active part of China’s strategy, it is very possible.

As you look at the RMB, also watch the INR at number 10. It’s still small, but it just showed up on this list a couple of months back.

Who did it displace? GBP!

Haitham Elsaid

Jun 19, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.