PODCAST | Invisible cargo, visible risk: The new reality of detecting trade finance fraud

David Cuckney

Jun 04, 2025

Gabrielle Reid

Apr 17, 2025

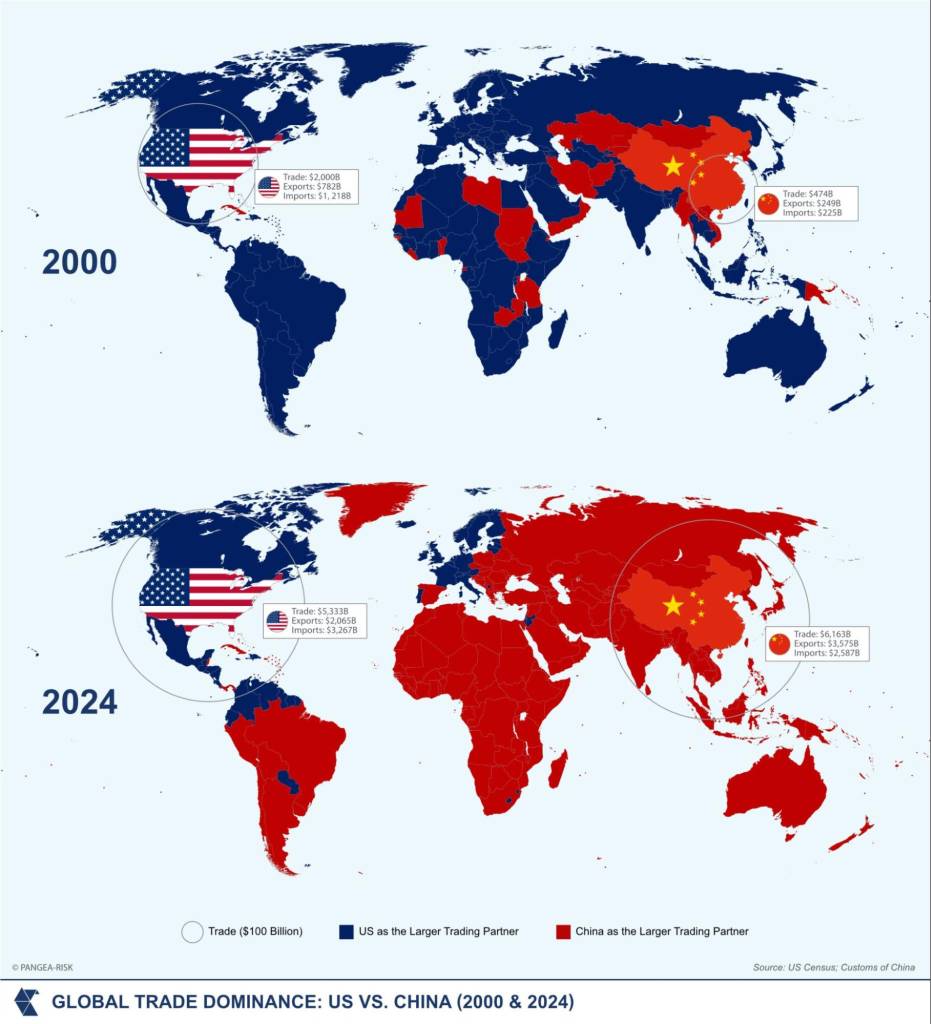

President Donald Trump’s “America First” trade policies have upended global commerce, shifting US policy from multilateral cooperation to protectionist tariffs and politically motivated trade measures. While the US seeks to rebalance trade deficits, so too is the Trump administration seeking to extract non-trade concessions from its partners. Africa’s regional integration efforts through AfCFTA and Gulf investment in alternative markets point to renewed adaptation among emerging markets. With shifting alliances, potential debt pressures, and evolving trade norms, businesses and policymakers must rethink traditional models to stay competitive.

President Donald Trump’s “America First” agenda has upended global trade norms. Under Trump’s leadership, the United States (US) has redefined its approach to international commerce by placing tariffs and bilateral negotiations at the centre of its strategy. This new posture departs from the multilateral frameworks and the most-favoured-nation principle that have underpinned trade for decades, with the US opting instead for targeted tariffs and politically driven trade measures. In doing so, the Trump administration has not only sought to protect domestic industries and reduce a burgeoning US trade deficit but it is using trade policy as a lever to secure non-trade-related concessions from its international partners and adversaries alike.

Yet, Africa’s push for regional integration through the African Continental Free Trade Area (AfCFTA) and Gulf region investors seeking alternative export markets signal a pivot towards greater resilience in the face of a more transactional US foreign policy. These strategic shifts have the potential to create more robust, diversified, and ultimately more competitive trade relations amid frontier markets. For policymakers and business leaders, the challenge is clear: embrace change and rethink traditional trade models. As global trade evolves, those who capitalise on the alternative paths this new reality offers could arguably fare better in the longer term.

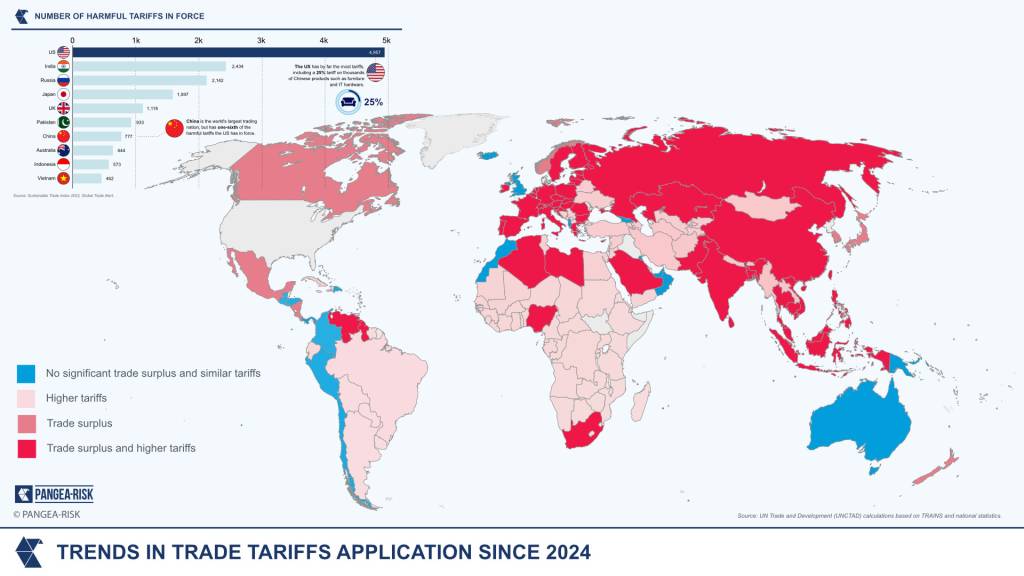

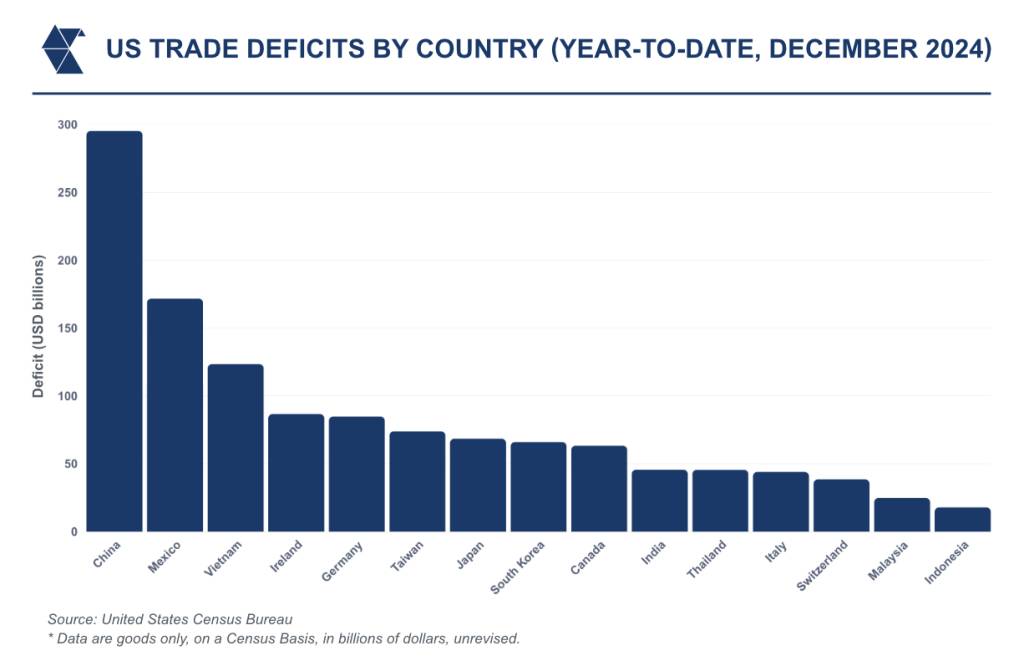

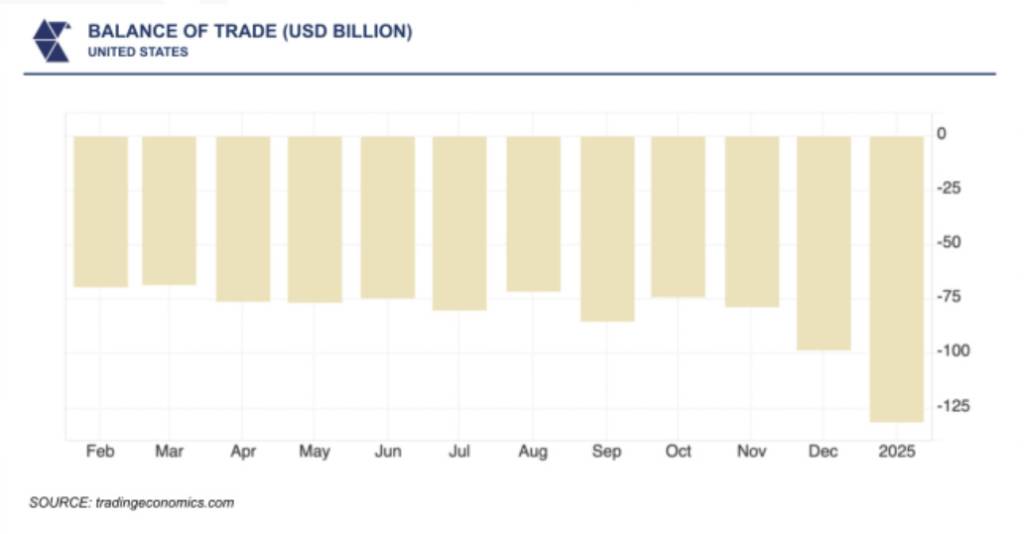

President Trump’s trade policy has been characterised by an aggressive recalibration of tariff structures, with a clear focus on reshaping America’s trade deficits. The administration’s initial moves included a proposed 25 per cent tariff on imports from Canada and Mexico, as well as a 10 per cent levy on Chinese goods. These measures were not introduced solely on economic grounds; they were also a response to concerns over migration and the illicit flow of fentanyl into the US. Yet, following Trump’s espoused “Liberation Day,” the US administration announced a baseline 10 per cent duty on all US imports and higher reciprocal tariff rates targeting countries with which the US runs a trade deficit. Despite President Trump’s partial reversal on 9 April, announcing a 90-day delay on reciprocal tariffs while maintaining the 10 per cent levy on all imports, the escalating US-China trade dispute and pending trade talks between the US and several other countries signals ongoing shifts in the global trade and tariff landscape.

The additional tariffs on steel and aluminium have reinforced the Trump administration’s objective of rebalancing trade flows amid a US trade deficit that reached USD 918.4 billion in 2024 after a 17 per cent increase in 2023. In this context, the introduction of new tariffs on key exports from China, the European Union, and Mexico remains likely after the 90-day grace period. Southeast Asian economies—including Vietnam, Taiwan, Japan, South Korea, and Thailand—will also find themselves vulnerable to new trade terms due to their respective export flows to the US. Although this offers some insight into the likely next steps for the US, the exact structure of its tariff regime is unclear, especially as the Trump administration increasingly wields trade policy for political goals and some countries, such as Israel, Japan and Vietnam, have been willing to come to the negotiating table.

Trade policies are being leveraged as a foreign policy tool to secure non-trade-related concessions from key countries, and this may mean that countries unrelated to the US trade deficit will become embroiled in new trade disputes. Trade-related threats have been used to secure commitments on border security from Canada and Mexico, NATO members have faced threats as a means to bolster proportionate European defence spending in the bloc, while Denmark and Panama have faced tariff threats in response to US geostrategic goals of increasing control over Greenland and the Panama Canal, respectively.

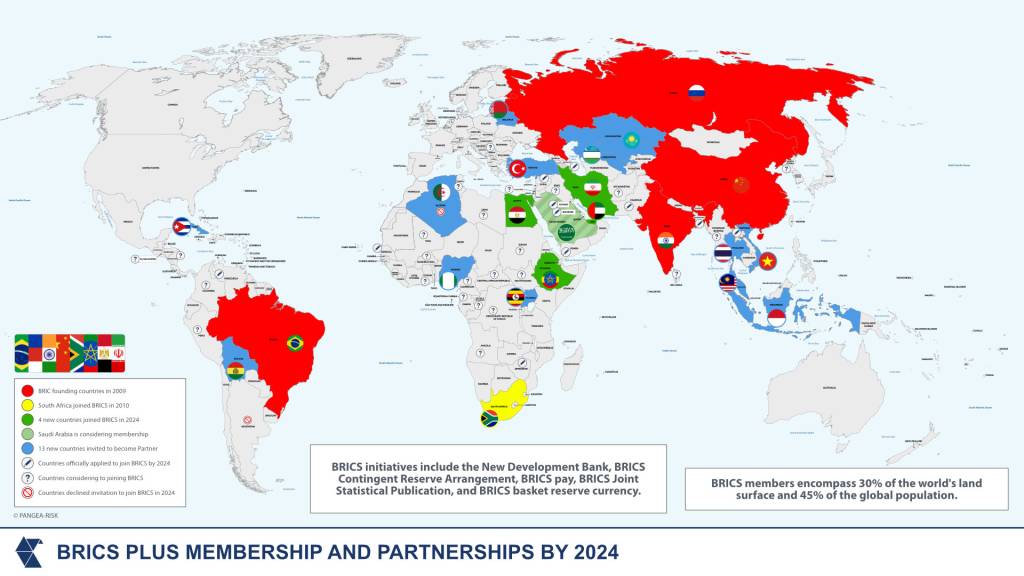

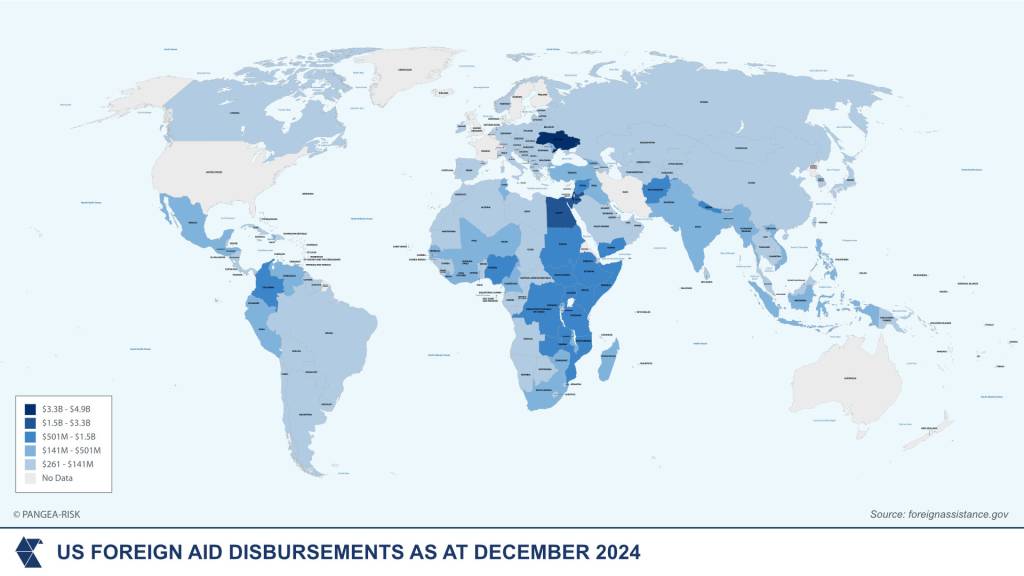

For emerging markets, the administration’s earlier threats of a 100 per cent tariff on members of the BRICS bloc in response to reports of the bloc exploring replacing the US dollar as a reserve currency signals the potential for punitive measures against members of the G7 alternative. With these pressures, countries in Africa, Asia, the Middle East, and Latin America are increasingly shifting their alliances towards Russia, China, Gulf states, and other non-traditional counterparts like Türkiye, Iran, and India.

Against this backdrop, it is clear that the evolving tariff landscape is not driven by pure economic calculations alone but by a broader geopolitical agenda. For business leaders, the challenge is to decode these tariff signals and anticipate future adjustments. An accurate reading of these dynamics is crucial to positioning supply chains, managing risk, and identifying new market opportunities in a world where tariffs and trade conditions become increasingly fluid.

Shift from multilateralism to bilateral bargaining

President Trump’s policy represents a fundamental shift away from the multilateral approach embraced by previous administrations. Traditionally, trade policy has been driven by broad agreements forged through international institutions like the World Trade Organisation (WTO) and regional pacts. Under Trump, however, trade negotiations are becoming intensely bilateral.

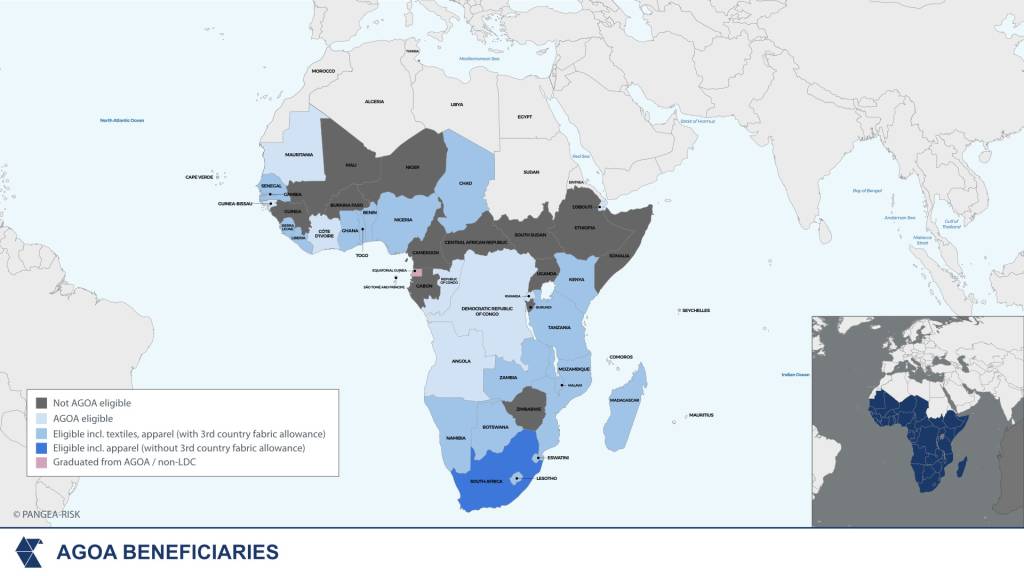

The African Growth and Opportunity Act (AGOA) was long hailed as a symbol of US commitment to positive trade relations with developing African economies. AGOA provided preferential, duty‐free access to the US market for eligible countries such as South Africa, Nigeria, and Kenya, thereby facilitating their integration into global supply chains. Yet, as the Trump administration’s focus has shifted towards bilateral deals, the future of AGOA has become increasingly uncertain. Recent threats—ranging from the imposition of new tax obligations to politically motivated trade penalties—have raised serious questions about the sustainability of the agreement beyond 2025.

African governments face a stark choice: continue relying on a US-centred preferential regime or diversify their export markets and strengthen regional trade ties. Countries that depend heavily on AGOA-related trade, such as Nigeria, which exported USD 3.5 billion worth of goods under the scheme in 2022, or Kenya and Madagascar—with exports of USD 614 million and USD 406 million, respectively—face significant vulnerabilities if preferential access is withdrawn. The emergence of the African Continental Free Trade Area (AfCFTA), for example, offers a promising avenue for reducing overreliance on the US market. By fostering intra-African trade and investment, AfCFTA represents a critical step towards building a more resilient regional trade landscape.

On the one hand, growing reliance on bilateral deals removes the blanket security regional agreements offer individual countries, but it also opens up opportunities to redesign trade deals to better suit individual national interests—provided the US will accept any associated concessions. Countries such as Kenya—which has already experimented with bilateral agreements with the US—may serve as models for a post-AGOA landscape.

Global south collaboration

Similarly, India had sought to bolster its bilateral ties with the US, offering a useful buffer should the Trump administration’s adversity towards the BRICS bloc grow while also seeking improved relations with China. The Indian government’s 2025/2026 budget, for instance, includes provisions for lower tariffs on goods deemed strategically important to the US. Such measures were implemented to help India secure favourable terms in its trade relationship with Washington prior to ‘Liberation Day’ and could serve as a model for other emerging markets seeking to mitigate the risks associated with a retreat from multilateralism if successful in offsetting the Trump administration’s threat of new tariffs against India.

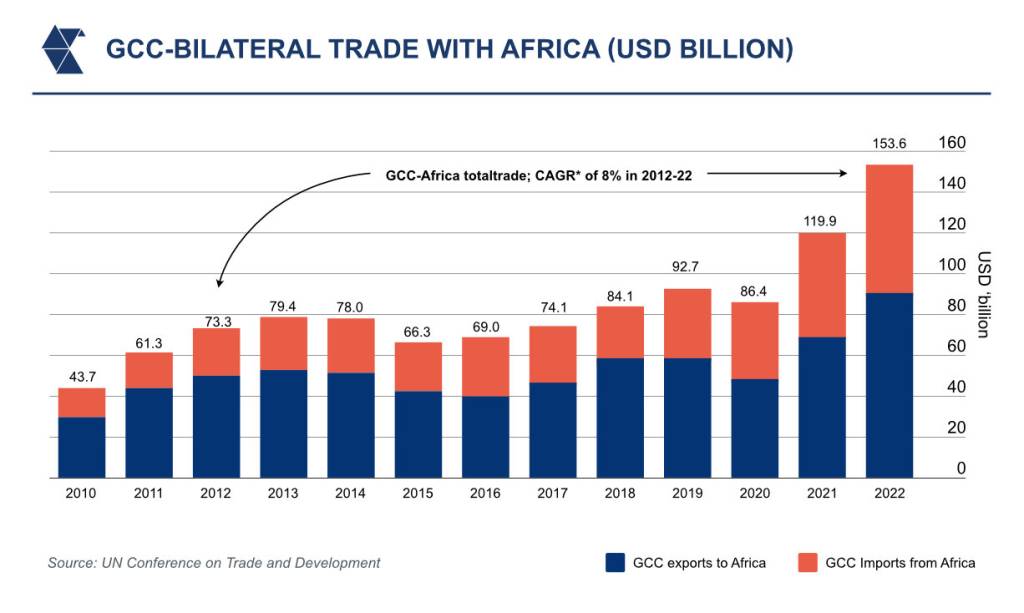

Those emerging economies able to effectively maintain cordial ties with the US alongside other strategic bilateral relations with the likes of China, the Gulf states, and regional economic blocs will be best placed to safeguard their trade. As the US retreats into protectionism and isolationism, emerging markets are increasingly turning to the Gulf Cooperation Council (GCC) as a robust alternative for trade and investment. Over the past decade, the likes of the United Arab Emirates, Saudi Arabia, Qatar, and Türkiye have invested over USD 100 billion in Africa, with last year witnessing 73 foreign direct investment projects worth more than USD 53 billion. Their investments span key sectors—energy, logistics, ports, agribusiness, mining, and renewable energy—highlighting a strategic commitment to diversifying their domestic economies while bolstering infrastructure and trade networks across the continent.

Enhanced by frameworks such as the AfCFTA, which promises a unified market of 1.7 billion people, the Gulf’s trade with Africa has soared to a record USD 154 billion in 2022. This burgeoning relationship not only provides Africa with much-needed economic diversification but also exemplifies the dynamic shift towards South-South collaboration in an era marked by Western retrenchment.

In an era marked by unilateral tariffs, shifting alliances and a retreat from multilateral frameworks, emerging markets face a complex and rapidly evolving trade environment. Trump’s trade policies have not only redefined tariff structures and diplomatic engagement but have also exposed vulnerabilities in the broader economic architecture of developing economies. With a trade deficit surging to USD 918.4 billion in 2024 and the spectre of punitive measures looming over strategic partners—from Canada and China to members of the BRICS bloc—business leaders must now contend with a new paradigm where trade is as much about political signalling as it is about economics.

For business leaders, recognising this dual role of trade policy is essential. Tariffs are no longer mere instruments of economic protection; they are also political tools that can reshape alliances and alter market dynamics overnight. This reality requires a recalibration of risk assessments and investment strategies. By understanding the geopolitical dimensions of trade policy, companies can better navigate the shifting sands of international commerce and protect their supply chains from sudden geopolitical shocks.

Against this backdrop, the strategic outlook for emerging markets must be both pragmatic and forward‐facing. Diversification of trade and investment partnerships is imperative. Initiatives such as AfCFTA and enhanced bilateral arrangements with partners like India and Gulf states offer a route towards greater resilience. At the same time, the development of agile, adaptive business strategies will be useful in navigating a more dynamic trade policy environment. This means building robust supply chains, investing in regional partnerships and maintaining a vigilant eye on geopolitical developments. In doing so, emerging markets can transform the uncertainties of a protectionist era into the foundations for sustainable, inclusive growth.

—

Pangea-Risk helps businesses mitigate these risks by providing in-depth country, political and macroeconomic risk intelligence, enabling leaders to anticipate and adapt to shifting global trade dynamics. Our analysis supports strategic diversification efforts, helping companies identify resilient trade and investment opportunities. By strengthening supply chain risk assessments and offering timely insights into geopolitical developments, we equip businesses with the tools to navigate uncertainty and build longer-term resilience.

David Cuckney

Jun 04, 2025

Eleanor Hill

Jun 04, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.