VIDEO | Why TF COP could finally shift the trade finance gap conversation into meaningful change

Duarte Pedreira

May 21, 2025

Deepesh Patel

May 21, 2025

Deepesh Patel

May 21, 2025

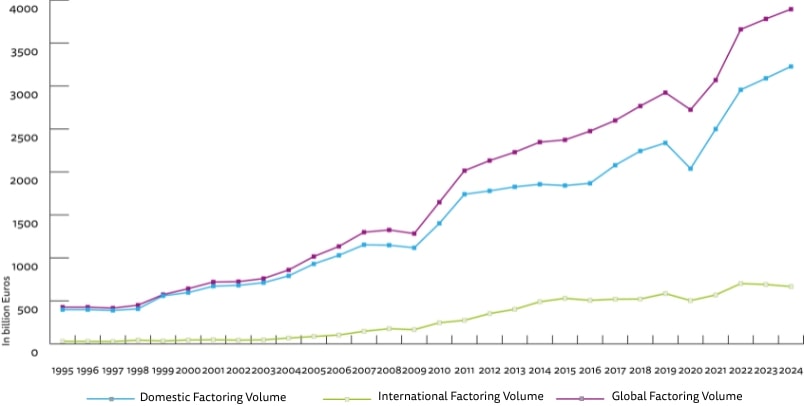

The global factoring industry demonstrated steady growth in 2024, with total turnover reaching €3.89 trillion—a 2.7% increase from €3.79 trillion in 2023. These preliminary figures were released by FCI, the global representative network for factoring and financing of open account domestic and international trade receivables, during the BCR 25th Annual Receivables Finance International Convention (RFIx25) held in London on 21–22 May 2025.

At the conference, FCI Secretary General Neal Harm presented these insights, highlighting the industry’s stability and its critical role in providing liquidity and risk mitigation for businesses worldwide, particularly SMEs navigating challenging economic landscapes.

The data indicates a period of consolidation for the industry following three years of robust post-pandemic recovery. Notably, factoring’s 2.7% growth outpaced the 1% increase in global product sales volumes, underscoring its resilience amid ongoing economic uncertainties.

The modest increase in the factoring market underscores its stability amid a year marked by significant global challenges, including geopolitical conflicts, high interest rates, and persistent inflation. While many sectors faced volatility, factoring continued to provide essential liquidity and risk mitigation for businesses worldwide, particularly SMEs navigating uncertain economic conditions.

Over the past two decades, factoring has demonstrated consistent growth, with a compounded annual growth rate of 7.8%. Its role in supporting open account trade and providing working capital solutions has become increasingly vital, especially during periods of economic uncertainty.

”Harm noted that factoring is no longer just a financing tool, it is “a legal purchase of a legally signed receivable” underpinned by an architecture of enforceable rules, education, and digital infrastructure. The strength of the FCI network, based on its Four Corner model, has helped members reduce dilution to below 3% and credit loss rates to less than 0.04%—among the lowest in financial services.

“This shows how our system is not just operationally efficient, but risk-robust,” Harm said.

4,451 companies contributed data for the 2024 figures, a record number for this annual survey. Europe accounted for nearly two-thirds of global turnover (€2.6 trillion), with Germany, France, the UK, and Italy leading. Meanwhile, India’s 120% growth and Argentina’s 122% surge stand out, pointing to rapid adoption in markets traditionally underserved by receivables finance.

But the figures also pointed to fragilities. Ukraine’s factoring volumes plummeted by 79%, while Hong Kong saw an 11% drop. The Middle East registered the sharpest regional contraction, down nearly 14%—a reflection of wider geopolitical and economic headwinds.

Taken together, the 2024 data suggest a maturing global industry—resilient, increasingly diversified, and more essential than ever to trade liquidity, particularly for SMEs navigating the sharp edges of today’s macroeconomic environment.

Europe held its ground as the world’s largest factoring market, generating €2.6 trillion in turnover in 2024, roughly two-thirds of the global factoring volume. Growth remained modest at 1.8%, but regional divergence prevailed. While Ukraine and the Netherlands recorded minor contractions, likely due to the conflict and economic recalibration, other markets in Europe surged. Moldova more than doubled its volumes (+122%), with North Macedonia (+63%), Georgia (+51%), Türkiye (+36%), and Latvia (+25%) all showing strong upward momentum, suggesting a renewed appetite for receivables finance across parts of Eastern and Southeastern Europe.

Asia-Pacific followed as the second-largest region, with €964 billion in turnover and a 2.4% annual increase. China contributed the most within three region, €679 billion of factoring volumes. Elsewhere in the region, growth was uneven, with Japan, India, Singapore, and Hong Kong posting mixed results in line with varied macroeconomic headwinds and domestic conditions.

In the Americas, factoring volumes climbed sharply to €271 billion, up 14.5% year-on-year. The United States and Canada led the rebound, posting a 28% increase after previous years of decline, while South and Central America continued their upward trajectory with a 5.8% rise. Brazil, Chile, and Mexico grew, as economic recovery and stronger SME demand helped drive adoption.

Africa’s factoring volumes reached €50 billion, reflecting a solid 5.9% increase over 2023. South Africa remains the continent’s dominant player, though Nigeria, Egypt, and Morocco are beginning to register as markets to watch.

The Middle East, by contrast, recorded a decline. Turnover fell to €8 billion—down nearly 14%—as geopolitical volatility and broader macroeconomic uncertainty weighed heavily on activity across the region.

The figures are compiled by FCI from its network of nearly 400 members across more than 90 countries, providing one of the most comprehensive datasets on global receivables finance available.

Explore the full set of statistics by clicking here.

Duarte Pedreira

May 21, 2025

Carter Hoffman

May 21, 2025

Trade Treasury Payments is the trading name of Trade & Transaction Finance Media Services Ltd (company number: 16228111), incorporated in England and Wales, at 34-35 Clarges St, London W1J 7EJ. TTP is registered as a Data Controller under the ICO: ZB882947. VAT Number: 485 4500 78.

© 2025 Trade Treasury Payments. All Rights Reserved.